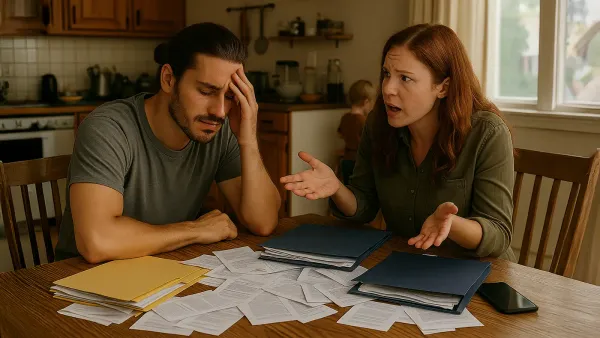

How to Start Again With Money (After You’ve Drifted)

A simple, non-shaming reset to start again with your finances after you’ve... drifted: find your next 3 risks, make 1 move that prevents fees, and set 1 automation to stay on track.

A simple, non-shaming reset to start again with your finances after you’ve... drifted: find your next 3 risks, make 1 move that prevents fees, and set 1 automation to stay on track.

When numbers come alive and taunt you it is not a nightmare it's dyscalculia.

You can’t fully suppress emotions (and you shouldn’t), but separating feelings from decisions is powerful.

The "best" app depends entirely on how your brain works with money.

What If You Built Your Budget Like a D&D Character Sheet? When traditional budgeting feels like trying to cast spells in a language you don’t speak, with zero spell slots and a DM who’s out to get you.

How to Turn Neurodivergent Urgency Into a Repeatable Financial Tool

Adapted from Robert Greene’s classic, reimagined for money minds that don’t play by neurotypical rules.

High time for a neurodivergent mission statement!

Borrow a Boss is an ADHD productivity method that turns overwhelming money tasks into short, 10-minute missions with clear starts and stops.

Why Momentum and Security Both Belong in Your Financial Garden

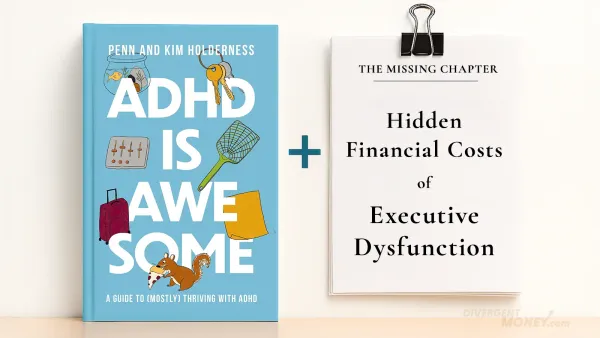

“We went to Target for toothpaste and came home with a lawn chair, three bags of kettle corn, and a ukulele. If we don’t have a list, we don’t go in. If we’re hungry, we don’t go in.” — ADHD is Awesome

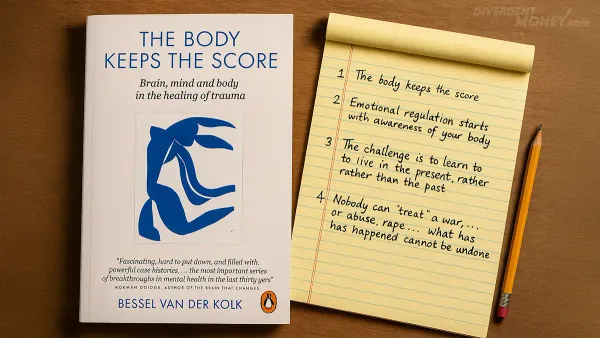

Trauma doesn't just live in your brain—it lives in your budget. Inspired by The Body Keeps the Score, this piece explores how financial shutdown, burnout, and shame aren't just bad habits—they're somatic survival responses. Especially for neurodivergent adults with CPTSD, ADHD, or

ADHD

TL;DR ADHD brains 🧠 often freeze when facing debt due to overwhelm, shame, or executive dysfunction. Body doubling—using a "Money Buddy" as an accountability partner—turns solo struggles into shared wins. How it works: A Money Buddy (cheerleader, co-struggler, etc.) creates gentle accountability, cutting through procrastination. Science-backed:

ADHD

Read time: 6 minutes | Ideal for: ADHD, Autistic, & neurodivergent money-makers Walk-away wins: A 7-day rhythm, dopamine-safe tactics, burnout protocol, and downloadable planner pack Many of the articles, ok– most of the articles, here are as much for you as they are self-care for myself an the entire team at

ADHD isn’t just about distraction—it’s a full-body experience that affects how we live, spend, work, and stay well. The cost of not treating it seriously? Up to 13 years off your life. This is your ADHD health trifecta: physical, mental, and financial health. Understand how they connect,

Autism

What You'll Learn in This Guide: The real cost of lifelong autism care—and how to prepare for itStep-by-step financial moves to make today (even if you're overwhelmed)How Special Needs Trusts, ABLE Accounts, and structured investments actually workWhy caregivers must protect their own retirement and

Autism

Temple Grandin isn’t a finance guru. She doesn’t run a budgeting podcast or pitch you the latest ETF (thank goodness!) I've never heard her talk about money outside the context of your worth in life. But buried in her vivid recollections, her radically visual way of

Autism

We thought the appointment was the finish line. It was just the starting gun. When your child is diagnosed as autistic, you don’t just walk out with answers. You walk out with a multi-thousand-dollar to-do list, a flood of paperwork, a part-time job in navigating systems, and a gnawing

TL;DR for the Security Seeker ✅ Predictability soothes your nervous system ✅ Write personal money policies — they act like guardrails ✅ Use weekly or biweekly financial reviews, never in the middle of panic ✅ If you're broke, your rules can still protect your mind ✅ Safety = not needing to panic when plans

TL;DR: Neurodivergent people don’t need more discipline or better money habits—they need a system that respects their energy, sensory bandwidth, and nonlinear cognition. This guide introduces a full-spectrum budgeting system built around the nervous system, not in spite of it. Understanding the Goose (That’s You) Most

Tips

📋TL;DR – The Neurodivergent Credit Loop ✅ Tiny win 📈 Small score bump 🧠 Confidence boost 🔁 Repeat You’re not behind. You’re rebuilding—with tools that actually work for your brain. Your credit score doesn’t define your worth. But it can shape your options. Let’s make those options work for

List

Over the next few weeks we'll be adding focused guides for each type in the Divergent Money Matrix. Stay tuned! In the meantime, if you haven't taken the quiz yet... Divergent Money Type Quiz 🛠 The Systems Hacker Core Pattern: Creates perfect financial systems but struggles with

Most couples argue about money. But for ND/NT couples, it’s not just about the dollars—it’s about the nervous system hijack that happens mid-sentence. 📋TL;DR: What You’ll Learn in This Article • Why ND/NT couples fight differently about money (hint: it’s not just about

ADHD

📋TL;DR: Naming your brain helps you manage money without shame by turning emotional chaos into something you can observe, coach, and even laugh at. Kevin strikes again. 🙄 It was well after 2 a.m. when Kevin decided we needed a $117 LED moon lamp. A classy one, not some

Get neurodivergent-friendly financial strategies that work with your brain, not against it.

Join our newsletter to receive:

We respect your privacy and will never share your information. You can unsubscribe at any time.