Budget Like a Vulcan: Cold Logic for Your Cold Cash

You can’t fully suppress emotions (and you shouldn’t), but separating feelings from decisions is powerful.

Why Spock Never Broke the Bank

Vulcans don’t do impulse buys.

They don’t stay up at 2 a.m. filling Amazon carts with stress purchases.

They don’t argue with themselves about whether they “deserve” takeout tonight.

They calculate, allocate, and execute.

And while none of us are pointy-eared, emotion-suppressing aliens, there’s a surprising amount we can learn from Vulcan logic when it comes to money.

The Vulcan Philosophy of Finance

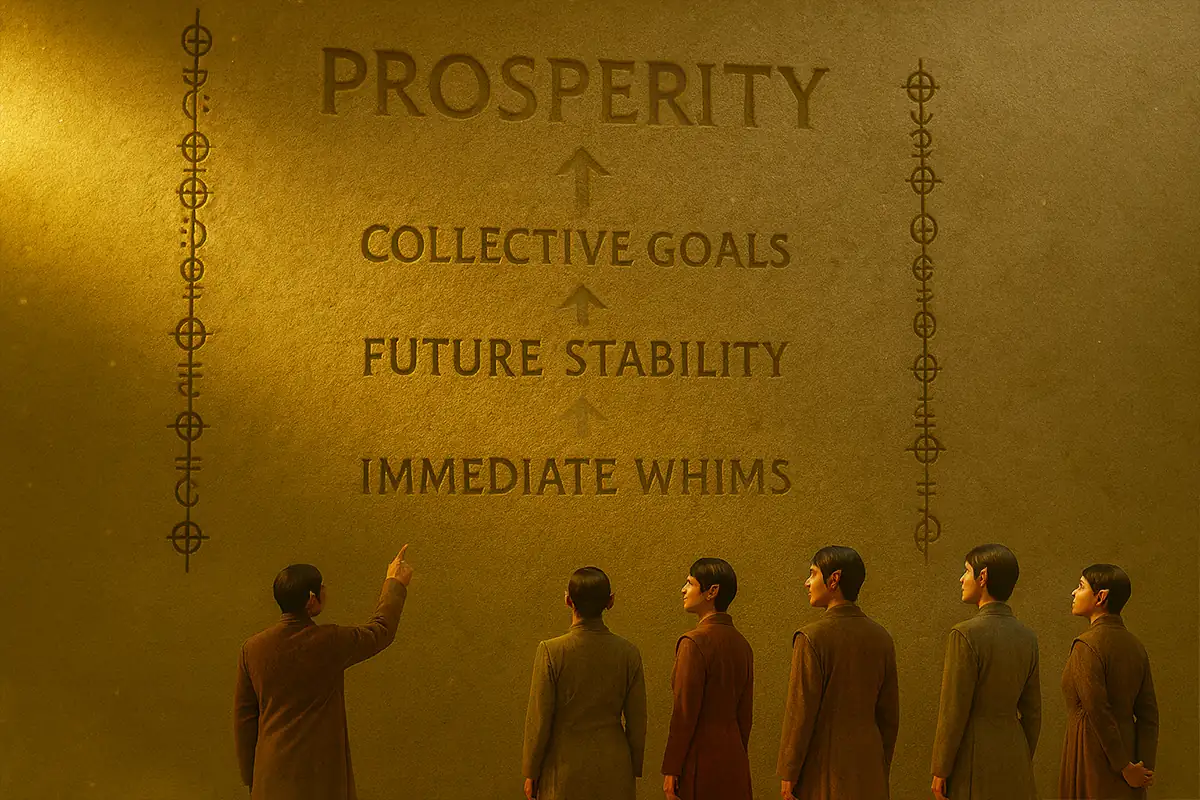

(Totally made up) Vulcan motto: “The needs of the many outweigh the wants of the one.”

Translated to budgeting:

- Collective goals (retirement, stability, debt-freedom) > immediate whims.

- Saving isn’t about “willpower.” It’s duty. It’s non-negotiable.

- Money decisions are judged by outcomes, not feelings.

Humans may crave dopamine hits, but Vulcans would say: your future self deserves more respect than your fleeting impulses [check out The Future You Strategy].

How to apply this philosophy: Use automation and pre‑commitment to remove emotion from decisions. For instance, automatically divert part of every paycheck to savings and investments before you see it. Treat those systems as sacred Vulcan routines— logical, repeatable, emotion-proof.

The Core Rules of Vulcan Budgeting

Money choices follow a logic chain, whether we admit it or not. The Vulcan framework makes it explicit:

Whims < Wants < Growth < Needs

Each represents a level of justification. Needs sustain life. Growth investments build capability. Wants can be indulged — consciously. Illogical spending, however, violates the Prime Directive: to act with reason even under emotional influence.

It’s not about austerity; it’s about awareness. The most logical budget still contains joy, it’s just scheduled joy.

1. The Prime Directive: Pay Yourself First

Before you touch a dollar, automate savings and debt payments. This isn’t optional, it’s logical.

2. The Logic Test

Strip away the story. Would you still buy it if emotion weren’t in the picture?

Example: “I deserve this gadget” → Emotion.

“This tool reduces costs and saves time” → Logic.

3. The Surak Allocation (50/30/20 Rule, Vulcanized)

- 50% = Essentials (survival + obligations).

- 30% = Growth (investments, education, skills).

- 20% = Discretionary (entertainment, travel).

Logic demands you cap the emotional tier.

4. The Pon Farr Exception

Emotions will erupt: birthdays, vacations, emergencies.

Vulcan solution: ritualize it. Set up “exception funds” so even when logic collapses, your finances don’t.

DOWNLOAD FREE VULCAN BUDGET WORKSHEET HERE

(Free, but for members only).

This is a fun way to keep you laser focused on evaluating the logical financial aspects of your life.

Logical Budgeting in Real Life

Here’s the moment of truth. Before buying, open your budgeting sheet. Look at the numbers. Ask: Is this decision logical according to the system I already built when I was calm?

You can’t fully suppress emotions — and shouldn’t. But separating them from your decisions is powerful. The system becomes your Vulcan overlay.

Example: A person with ADHD scrolls Amazon, pauses, and checks their spreadsheet. The numbers redirect the impulse. Joy delayed isn’t joy denied — it’s maturity, measured.

What does Vulcan budgeting look like when applied by actual humans?

- Grocery Shopping: Vulcan list is pre-set, optimized for nutrition per dollar, with zero “impulse snacks.” Humans: aisle of Oreos, budget wrecked.

- Subscriptions: Vulcan logic: keep one streaming service at a time. Humans: five auto-renewals, none watched.

- Tech Upgrades: Vulcan logic: upgrade when productivity gains outweigh costs. Humans: shiny-new syndrome every year.

The Vulcan approach doesn’t mean never enjoy life, it means design joy into the plan so it doesn’t sabotage your goals.

After each example, ask: “What would logic dictate here?” Raise and Write it down as a principle for your next spending decision.

Tools of the Vulcan Accountant

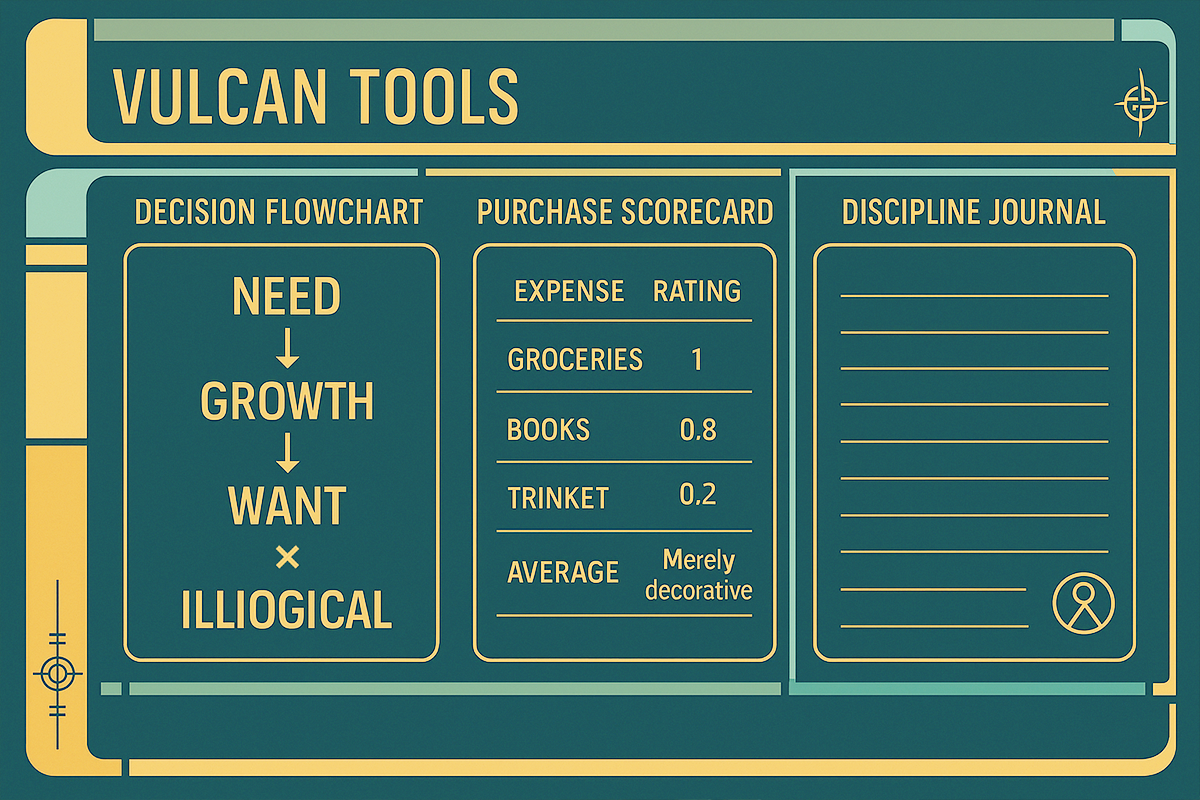

Every logical budgeting method needs instruments of precision that make discipline visible. Vulcans would never just talk about logic; they would quantify it. This is your rational spending system, a triad of tools designed to separate impulse from intention. The Decision Flowchart maps choices, the Purchase Scorecard measures their logic, and the Discipline Journal turns reflection into data. Together, they transform budgeting into an experiment in emotional clarity that feels both scientific and deeply personal.

- Decision Flowchart: A Spock-style diagram that walks you through: Need → Growth → Want → Illogical.

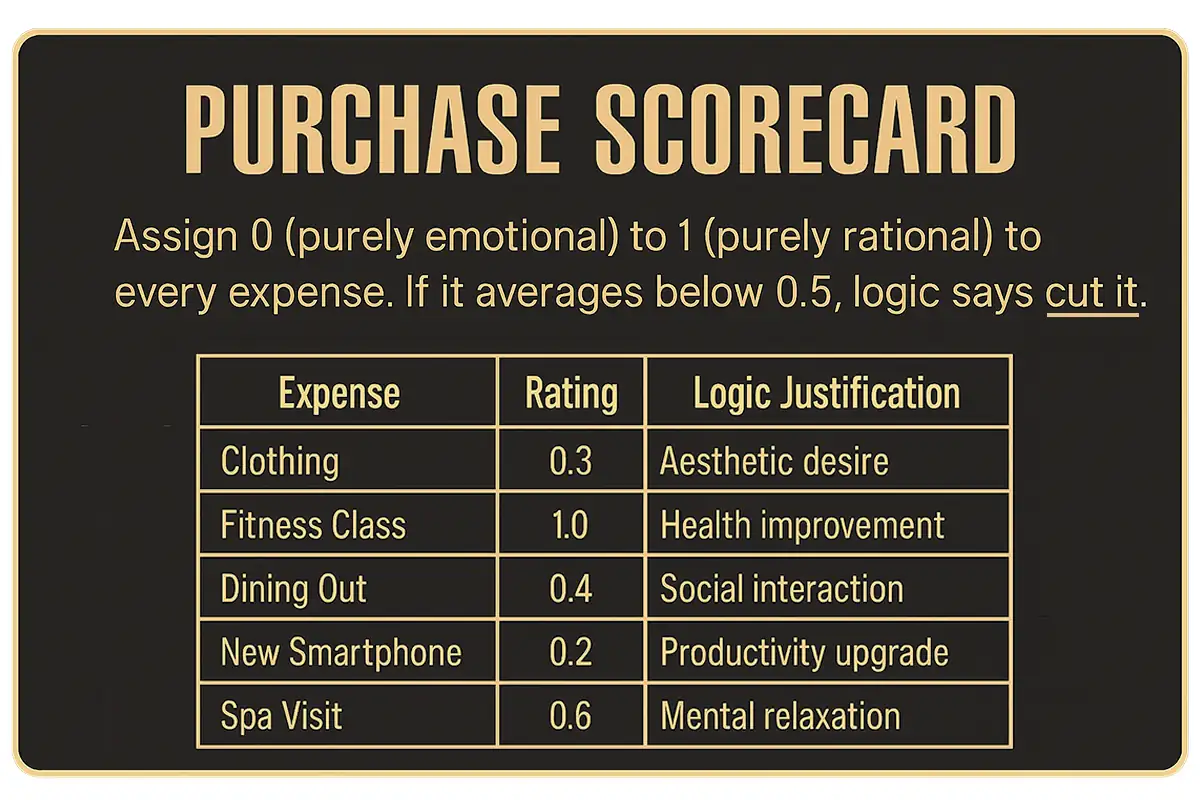

- Purchase Scorecard: Assign 0 (purely emotional) to 1 (purely rational) to every expense. If it averages below 0.5, logic says cut it.

- Discipline Journal: Replace guilt with data. Each week, log spending patterns like a Vulcan scientist analyzing experiments.

Why Humans Need a Little Vulcan Logic

Picture this: you’re hovering over the “Buy Now” button, brain lighting up like a warp core. Instead of giving in to the moment, you open your spreadsheet. The numbers don’t judge; they just tell you the truth. It’s your calm, future self talking to your impulsive present one. You don’t argue; you let logic win. Think of it as emotional outsourcing where the spreadsheet plays bad cop so your feelings don’t have to.

Here’s the truth: you can’t fully suppress emotions (and you shouldn’t). But separating feelings from decisions is powerful.

For people with ADHD, Autism, or impulse-prone brains, this “Vulcan overlay” works as an external logic filter:

- Instead of fighting yourself, let the system decide.

- Ask the spreadsheet, not your feelings.

- Treat budgeting like Starfleet treats physics: non-negotiable laws of reality.

Add an example here: someone with ADHD uses an automated bill pay app to avoid impulsive last-minute spending. Make it actionable and ND-relevant.

Logical Budgeting

Q: What is logical budgeting?

A system that removes emotion from money choices, relying only on clear rules and allocations.

Q: Can logical budgeting still allow fun?

Yes. The difference is fun is planned, not impulsive. Exceptions are ritualized.

Q: How do I start Vulcan budgeting?

Begin by automating savings (Prime Directive), capping discretionary (Surak Allocation), and tracking purchases with a scorecard.

If you find this article fascinating, here are few others you'd logically enjoy:

How to Automate Savings

Budgeting Advice from Another Planet

The Future You Strategy

Vulcan Proverbs of Prosperity

- “Live long and prosper… by automating your savings.”

- “Logic dictates you do not need three streaming subscriptions.”

- “Only a fool spends without a plan. Logic is the ultimate budget app.”

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.

Vulcan Logic, Human Copyrights: We’re just borrowing a little wisdom from Star Trek’s Vulcans to explore how logic meets money. All characters, species, and ideas like “Spock,” “Vulcan,” and “Starfleet” are trademarks and properties of Paramount Global (formerly CBS Studios and Paramount Pictures). Divergent Money has no affiliation or endorsement from Paramount — we just admire their commitment to logic. All copyrights and trademarks remain with their rightful owners. 🖖