When Your Budget Has PTSD: Financial Trauma & The Body Keeps the Score

Trauma doesn't just live in your brain—it lives in your budget. Inspired by The Body Keeps the Score, this piece explores how financial shutdown, burnout, and shame aren't just bad habits—they're somatic survival responses. Especially for neurodivergent adults with CPTSD, ADHD, or autism, understanding your felt experience of money might be the missing link to healing your finances.

QUICK START: What You’ll Walk Away With 👀

- Why budgeting can trigger trauma—even when nothing is “wrong”

- How shutdown, freeze, and shame play out in ND money behavior

- Somatic tools to reconnect with safety around your finances

- Where to go next for practical support and ND-adapted tools

Start Here If...

- You avoid money tasks but don’t know why ✅

- Budgeting feels emotionally unsafe 😬

- You’ve read The Body Keeps the Score and wondered, “what about my bank account?” 📉

SHAREABLE INSIGHT 💬

🧠 “Trauma isn’t in the content. It’s in the context.”

A budget spreadsheet can feel like a threat, not because of what it says, but because of what your nervous system remembers.

The Book That Named the Beast

Van der Kolk’s book is a revelation because it doesn’t treat trauma as a mental story—it treats it as a body state. It insists that what happens to you physically shapes how you think, feel, and act—especially when it comes to safety and danger.

If you grew up in financial instability, lived through job loss, eviction, or constant scarcity—you didn’t just learn “money is stressful.” You felt it. You stored it. In your fascia, in your heartbeat, in the way your stomach turns when an email from your bank arrives.

For neurodivergent folks, especially those with AuDHD or CPTSD, this connection between body and money isn’t abstract—it’s everyday life. Trauma doesn't live in memory alone. It lives in the moment your hands tremble before logging into your bank account. It lives in the pit in your stomach when a friend wants to split the check. And if no one has ever told you that’s not laziness—it’s survival—you might carry shame that doesn’t belong to you...

Somatic Finance: Your Nervous System Has a Ledger

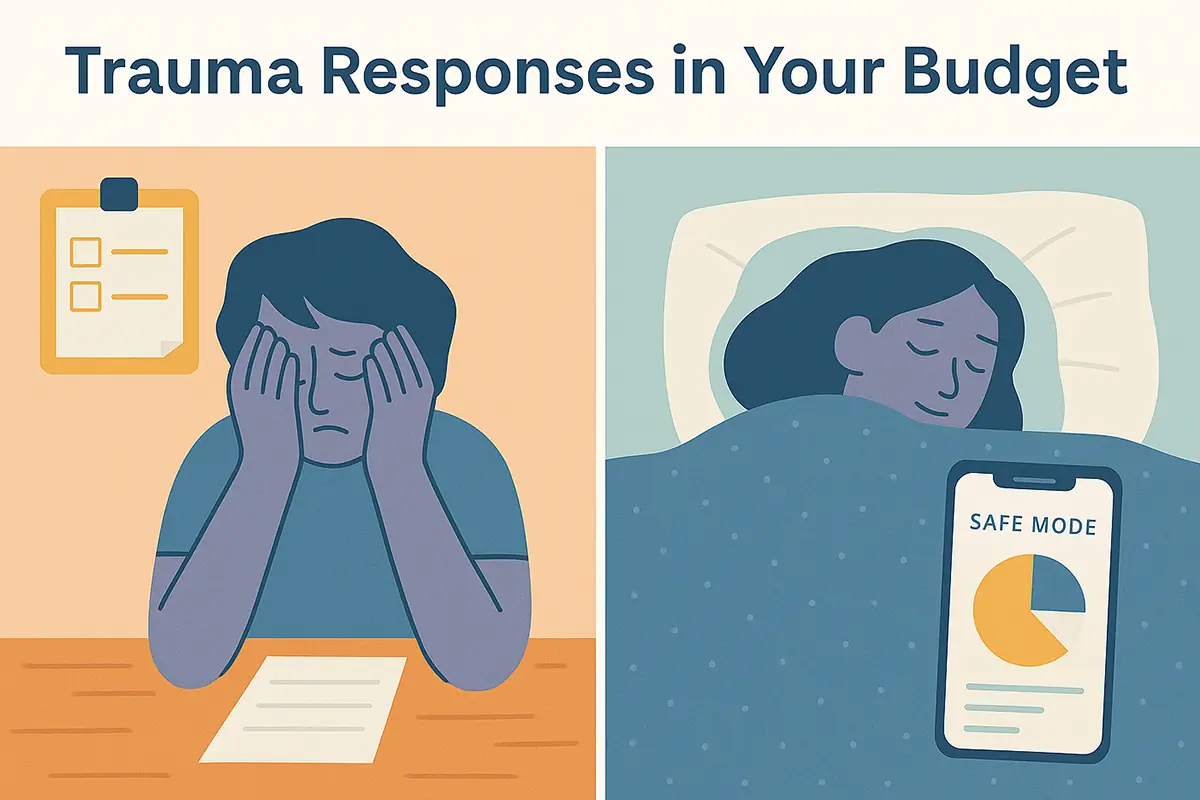

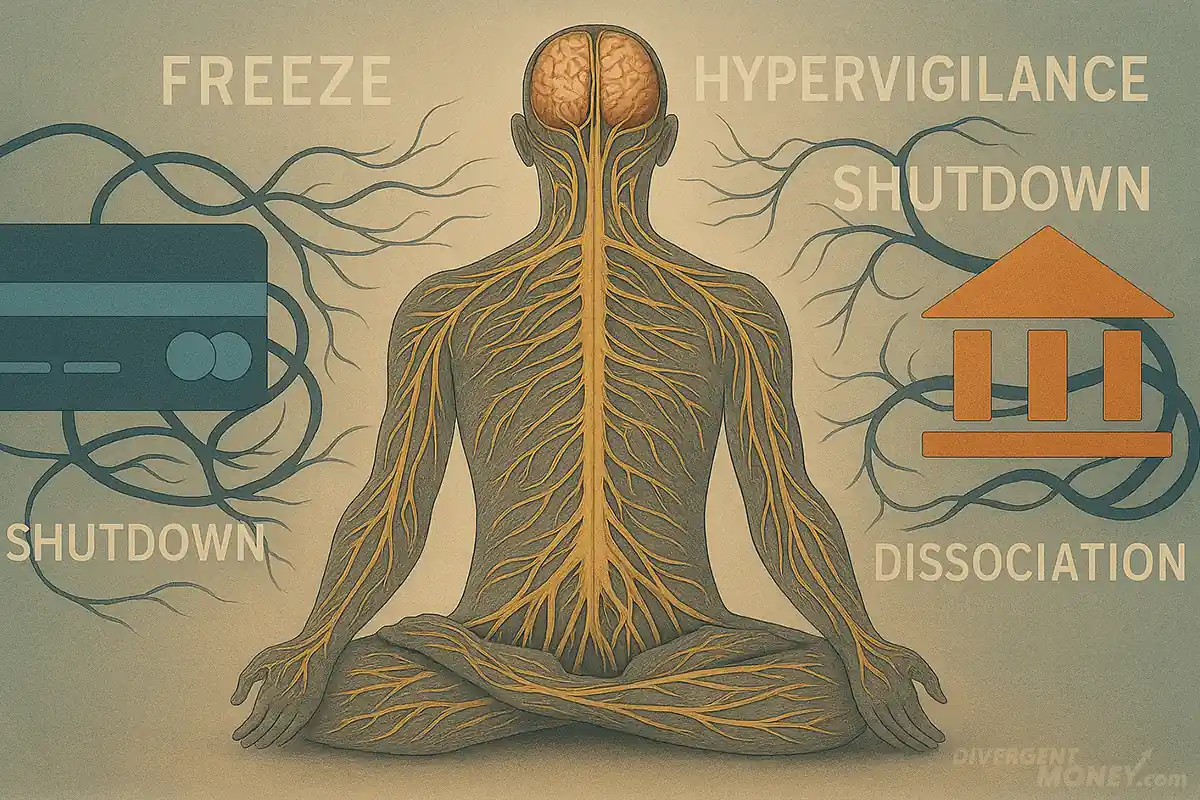

Van der Kolk explains how trauma creates lasting physiological patterns—tight muscles, shallow breath, hyperarousal, dissociation. What if your money habits follow the same body logic?

People with financial trauma often operate in freeze or fawn mode. You might:

- Numb out instead of tracking spending

- Panic and overspend to regain control

- Avoid anything that reminds you of bills

These aren’t “bad habits.” They’re strategies your body learned to protect you. And unless your financial plan speaks to your nervous system—not just your logic—it won’t stick.

Somatic finance starts here: Before you budget, breathe. Before you automate savings, notice your heart rate. Before you punish yourself for avoiding money, ask: “What danger does my body think I’m in?”..

Why Budgets Feel Unsafe (Even When They're Logical)

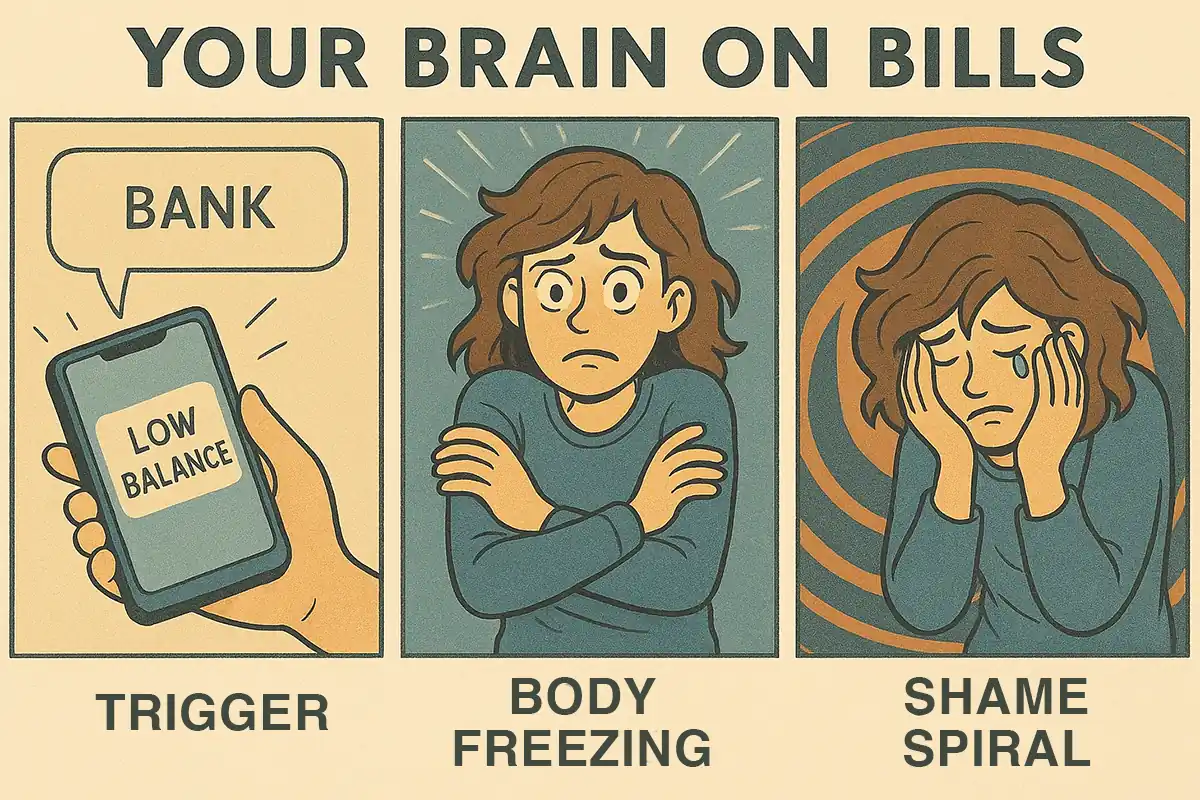

Let’s say you’ve built a spreadsheet. You’ve listed your income, sorted your bills, even set a savings goal. It’s logical. It’s responsible.

But then you can’t open it. You feel foggy. You stare at the screen, then close it. Again.

Here’s the truth: If your nervous system reads the act of budgeting as a threat, your body will shut it down like it’s a predator. This isn’t a character flaw—it’s a survival system misfiring in a modern context.

This is especially true if you:

- Grew up around money shame, secrecy, or control

- Experienced instability (like eviction or food insecurity)

- Had caregivers who modeled panic, avoidance, or rigidity around money

Trauma wires the body to expect repetition. So even if you know your bank account is fine, your body still reacts like it’s 3am and the power just got shut off again.

Until safety is felt—not just understood—change will feel impossible...

Interoception, Hypervigilance, and the $5 Latte

Interoception is your ability to sense what's going on inside your body—hunger, heartbeat, muscle tension. Many ND folks struggle with this. It's either dialed down too low (you don't notice you're exhausted until you collapse) or way too high (you feel every twitch and twinge).

Now apply that to money: The coffee purchase you didn’t plan becomes a full-body shame spiral. Or you spend compulsively just to feel something in a numb stretch. Or you suddenly feel tightness in your chest and don’t realize it’s because rent is due tomorrow.

Combine that with hypervigilance—constantly scanning for danger—and you get a nervous system that overreacts to every financial signal. A sale notification becomes an impulse buy. A budget error becomes a meltdown. A bill becomes a body blow.

You’re not being dramatic. You’re being accurate. Your body just hasn’t been taught the difference between financial discomfort and financial danger...

CHECK-IN: Are You in Financial Freeze Mode?

✅ You avoid checking your bank account for weeks

✅ You feel nauseated or foggy when budgeting

✅ You over-explain spending to others—then crash into shame

✅ You feel like “being bad with money” is a core identity

If any of these resonate, your nervous system may be protecting you—not sabotaging you.

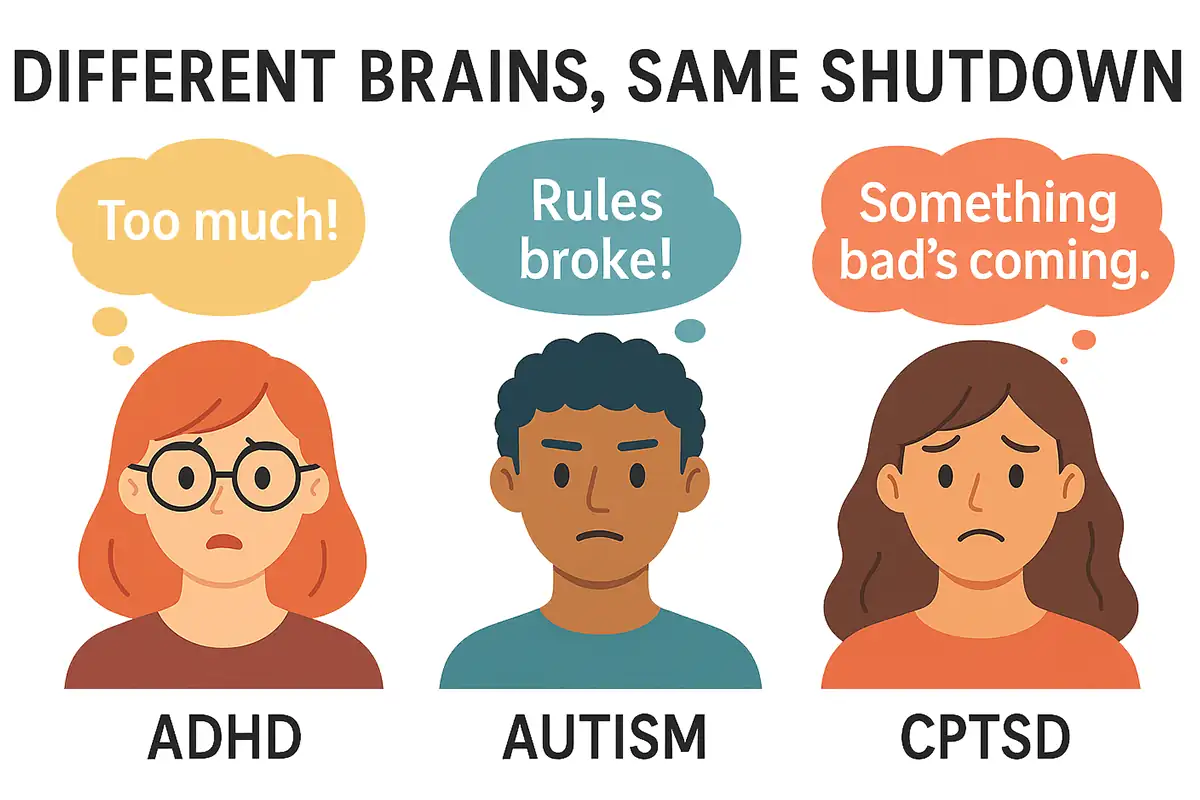

How Money Trauma Shows Up in ND Brains

ADHD: You hyperfocus on budgeting for 6 hours straight—then burn out and avoid it for 3 weeks. You impulse-spend to regulate. You over-correct with shame budgeting.

Autistic: You build the perfect financial system—then spiral when a surprise expense breaks your rules. You mask confusion during financial conversations. You get decision fatigue from trying to calculate every social variable of splitting dinner.

AuDHD: You bounce between panic and perfectionism. You know what to do, but can’t get yourself to do it. Your body says no before your brain can explain why.

Trauma shows up as shutdown, disconnection, and shame—but ND brains often amplify or distort that signal. You’re not just “bad with money.” You’re navigating a nervous system that got rewired for survival...

Building a Bottom-Up Budget: Safety First

Van der Kolk shows how trauma lives in the body—not just the mind. It hides in muscle memory, posture, breath patterns, gut reactions. It’s the flinch you don’t notice, the numbness you rationalize, the heart rate spike when a bill arrives.

And if you’re autistic, ADHD, or both (AuDHD), that body already processes the world differently. For you, sensory input is often louder. Internal signals—like hunger, fatigue, or tension—might come through as static or blaring alarms. Emotional regulation is routed through a different maze. The trauma doesn’t just live in the body; it takes up more roomthere. What looks like avoidance or procrastination is often a form of internal crisis management. You’re not just budgeting under stress—you’re budgeting under siege.

Trauma treatment often starts with bottom-up tools—movement, breath, rhythm—before talk therapy. These methods work because they engage the body first, helping the nervous system find regulation and grounding before diving into the analytical or verbal. Van der Kolk emphasizes that until the body feels safe, the brain can’t truly process or resolve trauma.

That same principle can—and should—be applied to financial healing. If your body goes into panic every time you think about money, no amount of spreadsheets or advice will land. Bottom-up finance means making budgeting feel physically safe: calming your breath, softening your muscles, creating rituals that tell your body, “This is not a threat.”..

The Body Keeps the Score. But You Can Rewrite It.

Want a practical follow-up? Read Emergency Funds: The ADHD-Friendly Guide for actionable steps on building a fallback plan when your nervous system goes into shutdown.

If this article helped you understand why budgeting feels impossible, Dollars and Distractions: Why ADHD Brains Struggle With Budgets breaks down how to adapt systems to your actual executive function capacity.

Still in freeze mode? Debt Money Buddies: Why ADHD Body Doubling Hacks Work shows how to make money tasks feel safe and social—even when you’re running on fumes.

Want to Go Deeper?

Try this companion worksheet:

📅 DOWNLOAD The Financial Safety Inventory (Inspired by The Body Keeps the Score) 👇

Track your felt safety, identify shutdown cues, and reframe your budget as a nervous system ally.

💡 Check out the "Reset Week" - what it is and how to implement one into your life!

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.