What "ADHD Is Awesome" Left Out: The Hidden Financial Costs of Executive Dysfunction (And How to Navigate Them)

“We went to Target for toothpaste and came home with a lawn chair, three bags of kettle corn, and a ukulele. If we don’t have a list, we don’t go in. If we’re hungry, we don’t go in.” — ADHD is Awesome

Read Time: 4 minutes | Audience: ADHD adults and partners overwhelmed by money spirals

I've found over the years that when someone loves an idea you have, they often jump in with ideas of their own. That's what this review is going to do- so please forgive me Penn and Kim! The Divergent Money team loves "ADHD Is Awesome" by the Holdernesses. It's a classic. It's fun, relatable, does a great job reframing executive function.

As a personal finance site though, we have some thoughts...

The Missing Chapter

Hidden Financial Costs of Executive Dysfunction

So here’s a fun story (and by fun, I mean horrifying): One time I got charged a $35 overdraft fee because I didn’t move money from one account to another. The money was there. I just... didn’t transfer it. And when the text from the bank came in, I didn’t open it. I watched videos of raccoons stealing hot dogs and trying to eat cotton candy instead. It felt safer. But with my now lower balance, an incidental charge came through, and caused a second bounce!

You may have similar stories.

I picked up ADHD Is Awesome, laughed at the sticky notes and snack spills, cried a little (in a good way), and felt seen. But then I waited for the chapter on money- 'cause that's what we do here- you know, the one where you accidentally ignore a bill for 93 days because “money stuff” lives in a shame folder in your brain labeled DO NOT TOUCH.

That chapter never came.

This Book Is Awesome. But...

Don’t get me wrong. This book is top-notch.

Funny.

Honest.

Written by people who clearly know what it’s like to walk into a room and forget why they’re in a room. But if your, or your loved one's, ADHD ever cost actual dollars (hint, it does)—or relationship trust, or your sense of financial safety—well, that part didn't make the cut.

So guess what? We wrote the chapter! You’re reading it.

And if you don’t have a bank app, or a friend to call, or money to move—this chapter is still for you. You deserve dignity and systems, too.

Let’s Talk About the Chaos We’re Not Supposed to Talk About

ADHD doesn’t just mess with time. It messes with money. It convinces you that your bank app is radioactive. It whispers, “You’re terrible at this,” every time you get a late fee. And you start to believe it.

Here are some Greatest Hits from the ADHD Financial Hall of Fame:

- Paid for three subscriptions you didn’t mean to because your trial ended six months ago, and you couldn’t bring yourself to cancel.

- Bought $47 worth of gummy vitamins in a hyperfocus moment.

- Got into an argument with a partner over a forgotten bill, then avoided all money talk for a month.

- Paid a $60 parking ticket three times because you forgot you already paid it. (Yes, really.)

These aren’t flukes. They’re patterns. And they have names: executive dysfunction, impulsivity, rejection sensitivity, and money shame. (The real Fab Four.)

Why Nobody Talks About This

Because it’s messy. Because it’s hard. Because we’re taught that money problems = irresponsibility. When really, for a lot of us, it’s just: “My brain short-circuited when the bill came, so I shoved it under a pile of laundry and prayed.”

Most ADHD books skip this. Maybe because it’s not funny beyond a certain point. Maybe because it’s scary. But let’s go there- because you’re not the only one. And because there are ways through it.

OK, So What Do We Do?

Here’s what’s worked for us and other very-brainy, very-messy, very-human ADHDers:

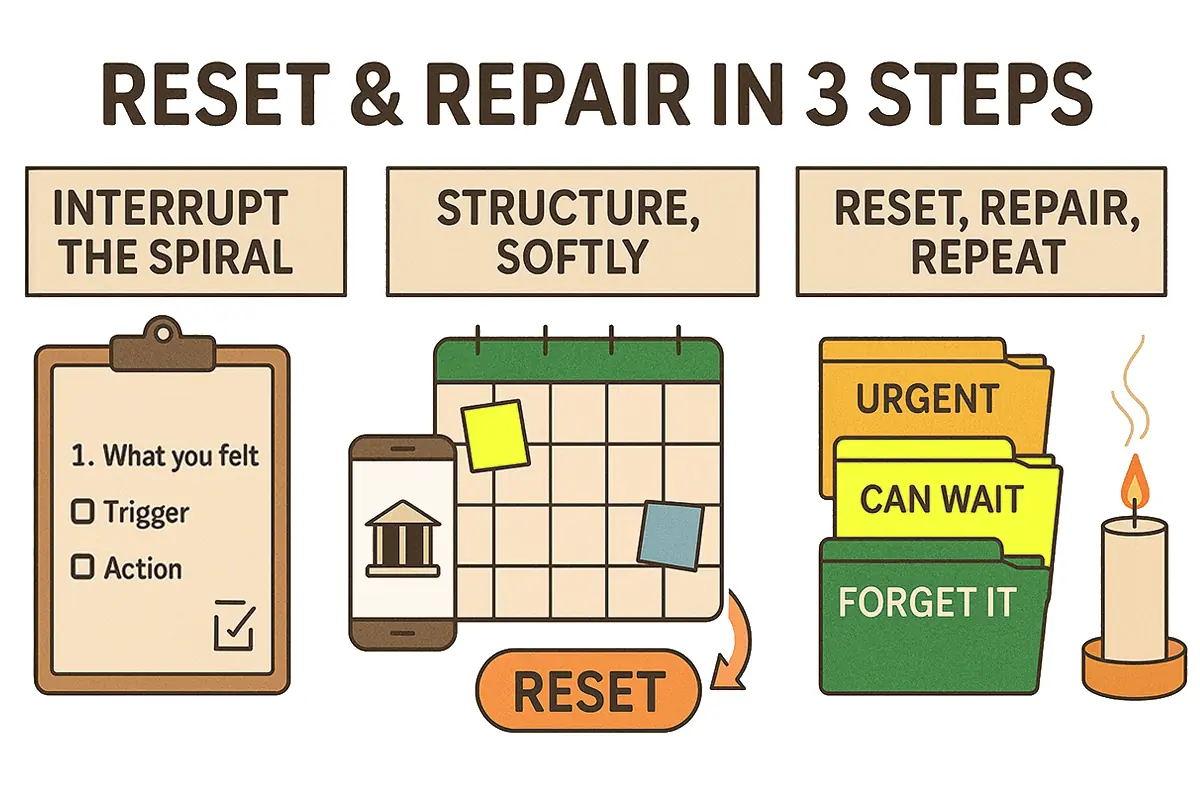

Step 1: Interrupt the Spiral

- Do a Micro-Reset. Pick one thing: open your bank app with a friend on the phone, or set a reminder to look at one bill. That’s it. If that feels impossible, literally set a timer for 2 minutes and just think about it.

- Try the Three-Column Reset: Write down 1) what you felt, 2) what triggered it, and 3) what action you took. No judgment. Just observe the pattern.

Step 2: Structure, Softly

- Use visual systems: sticky notes, whiteboards, a calendar taped to the fridge. If it works for toddlers and pilots, it works for you.

- Automate anything you can with Default Mode Finance. Coming this week from the DM team, so check back soon or make sure you're signed up for updates.

Step 3: Reset, Repair, Repeat

- Create a ritual called Reset Week. Light a candle, gather your receipts, and triage them like a chaotic ER doc: Urgent / Can Wait / Forget It Happened. You can download the checklist here, reset week protocol pdf:

- Talk to your people. Use our disclosure scripts for sharing financial oopsies with partners without spiraling into shame. Here's an example:

“Hey, I’ve been avoiding looking at the credit card because I’m overwhelmed. I didn’t want to hide it from you—I just froze. Can we look at it together and figure out a game plan?”

This one models both disclosure and an invitation to collaborate—without shame. Download more below:

FAQ (That Nobody Wants to Ask Out Loud)

Q: Why do I avoid my bank account even when I know I have money?

A: Because money = danger brain zone. Your brain isn’t wired to process long-term consequences, so you avoid the stressor to avoid the spiral.

Q: Am I bad with money?

A: No. You’re navigating a system built for neurotypicals who remember due dates, don’t panic-scroll Zillow at midnight, and don’t dissociate when asked to choose a health plan.

Q: What’s the first step that won’t make me want to cry?

A: Do a Micro-Reset! One tiny win. That’s your way back.

Q: What is a money spiral?

A: A loop where executive dysfunction, shame, and avoidance build until you stop engaging with money completely. Often triggered by burnout, overstimulation, or perceived failure.

The 'System' Might Be... Just a Little Broken

We don’t just want to help you budget. We want to help you breathe again when you open your credit card app. We want to help you laugh at your 2 a.m. gum purchase and fix the automation that caused it.

“If budgeting advice makes you feel like a failure, it was written for the wrong brain.”

So consider this your missing chapter. The one where financial chaos isn’t a punchline—it’s a real thing we can handle, together.

And hey—this isn’t your fault. But you get to choose what happens next.

The Holderness Family

Now for the special treat! If you don't know of or follow the Holderness family YET. Check out their amazing videos on Instagram, like now. Don't wait. You deserve a smile!

🔧 Want help with the tools?

We built a whole ADHD-friendly toolkit at DivergentMoney.com:

💌 Or just join the newsletter. We’ll bring the reset to your inbox. Snacks optional.

📬 Subscribe to the Divergent Money UPDATES – For any time we publish new articles.

📬 Subscribe to the Divergent Money NEWSLETTER – Weekly tips made for how your brain works

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.