Tiny Habits for Big Money Wins

A Neurodivergent Take on BJ Fogg’s Behavior Blueprint Book

⭐️⭐️⭐️⭐️½ (4.5/5 stars)

Budget apps failed you. This doesn’t have to.

In Tiny Habits: The Small Changes That Change Everything, behavioral scientist and Stanford lab founder BJ Fogg delivers a deceptively simple toolkit for behavior change. It’s marketed broadly as a life-hack manual for anyone, but through the lens of neurodivergent personal finance, it hits different.

We’re talking game-changer for ADHD brains, autistic planners, anxious avoiders, and folks who live in the push-pull of high aspiration and low activation energy.

This is your Divergent Money review of Tiny Habits, optimized for real people navigating real financial stress—often with systems that weren’t built for our wiring.

TL;DR: Why This Book Matters for Neurodivergent Financial Lives ⚡️

Fogg’s approach? Start smaller than you think is worthwhile, anchor it to something already happening, and celebrate like you just paid off your student loans.

He flips the script on willpower and gives us a structure that works with our brains—not against them.

Tiny Habits in a Nutshell 🔍

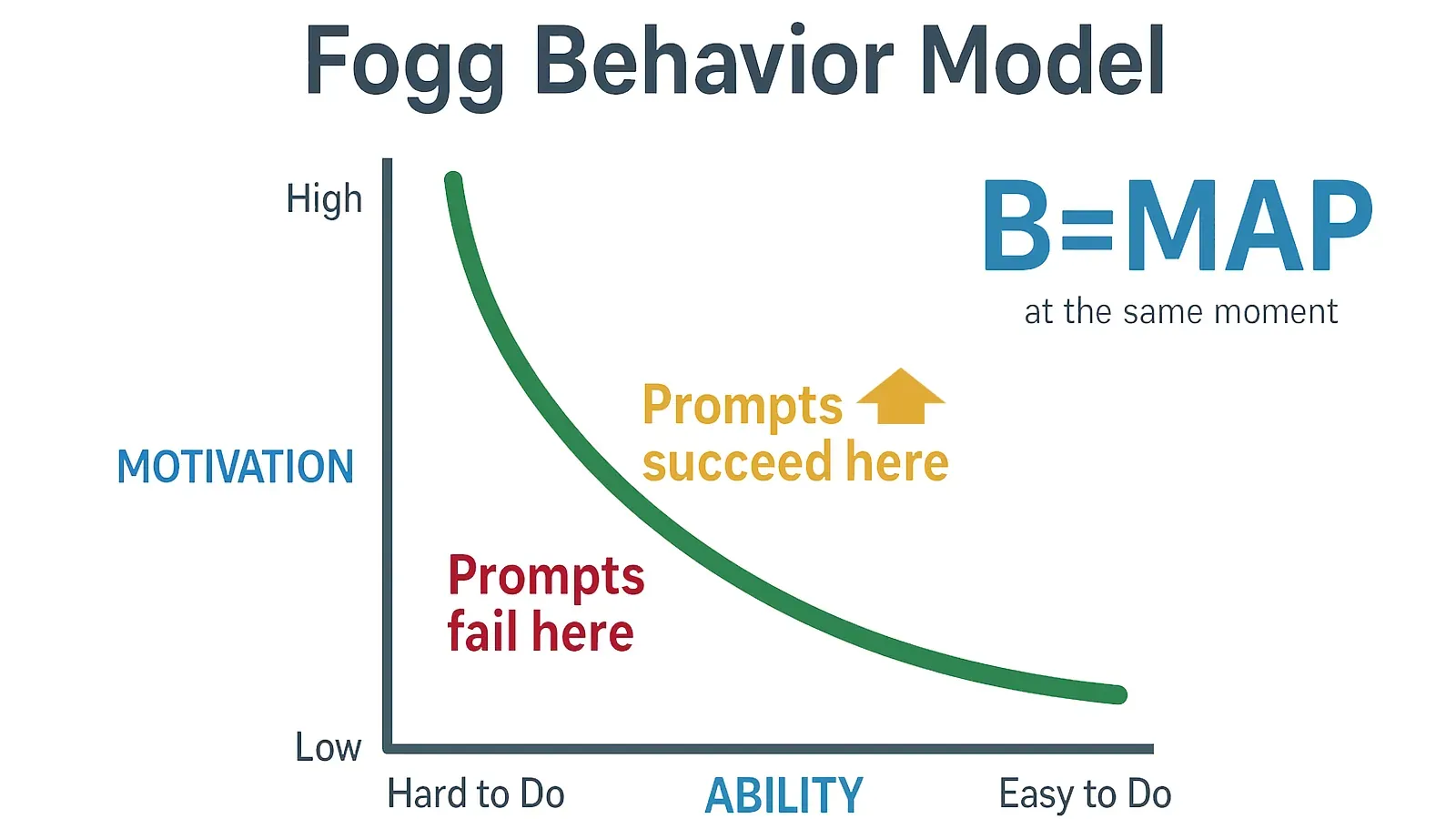

The book revolves around the Fogg Behavior Model:

Behavior = Motivation + Ability + Prompt

Rather than pushing yourself to “just do it,” Fogg teaches you how to make habits so small they slide right under the radar of resistance.

You’re not budgeting your entire life in one Sunday spreadsheet sprint—you’re opening your bank app after brushing your teeth. You’re not overhauling spending—you’re deleting one unused subscription. That’s a win.

Applying Tiny Habits to Your Financial Life (Especially If You’re ND) 💸

1. The Magic of Tiny = Sustainable

Trying to track every expense in a neurotypical budgeting app? Burnout city.

Fogg’s framework says: just track one purchase today. That’s enough.

Once a habit feels easy—and not emotionally loaded—you’re more likely to repeat it. Tiny habits grow organically. No shame, no shoulds.

2. Anchors Work Better Than Alarms

Forget push notifications (which many of us learn to ignore). Fogg’s system anchors habits to things you already do.

- After I pour my coffee → I check my spending dashboard

- After I plug in my phone at night → I transfer $1 to savings

This is massive for ADHD and autistic folks who thrive on structure but struggle with time awareness.

3. Celebration as Dopamine Strategy

Fogg argues that reinforcing success immediately rewires your brain. For those of us chasing dopamine (hello ADHD), this is gold.

So yes, literally say “Boom! I did it!” after checking your bank account. It works.

Where It Shines (And Where It Doesn’t) 🔎

✅ What We Loved:

- Accessible Framework: No special tools or perfect days required.

- Shame-Free Philosophy: Fogg never blames you when things don’t stick.

- Neurodivergent-Friendly Design: Breaks from rigid discipline models.

- Plug-and-Play for Money Goals: Apply this to debt, savings, investing, even credit repair.

⚠️ What’s Missing:

- Not Specifically Financial: You’ll need to translate concepts into money moves yourself (DM companion guide coming soon).

- Neurodivergence Isn’t Named: While the system is friendly, the book doesn’t explicitly acknowledge ND readers.

Tiny Finance Habits to Try Today 🧠

Here are 5 habit recipes you can anchor right now:

- After I brush my teeth, I’ll check my credit score.

- After I close my laptop, I’ll log one transaction.

- After I microwave lunch, I’ll delete one shopping app.

- After I put on socks, I’ll move $5 to savings.

- After I hear a “money” ad on YouTube, I’ll say “I’m building wealth in my own way.”

Add a fist pump or a “yes!” after each. Seriously.

The Divergent Money Verdict ⚖️

If you’ve struggled with financial follow-through, Tiny Habits isn’t just a nice read—it’s a blueprint that works with your brain chemistry.

It doesn’t make promises it can’t keep. It doesn’t tell you to hustle harder. It offers something rarer: a way to grow sustainable change without triggering the burnout loop.

It’s not about doing more. It’s about doing less—but more often.

Final Score: ⭐️⭐️⭐️⭐️½ (4.5/5)

We docked half a point for not speaking directly to neurodivergent readers—but the system itself couldn’t be more aligned with how many of us need to operate.

Ready to start?

You don’t need motivation. You need a micro-action.

➡️ Start here: After reading this, say out loud: “I can do money my way.” Or if you find youself on Degoba, "My way, do money I can"

Then, do one tiny thing with your money today.

We’re cheering for you. May the force be with you!

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.