The Adaptive Flowist: How to Budget When You Only Have Energy Twice a Month

“I either go full spreadsheet samurai… or I ghost my bank account for three weeks.”

Sound familiar?

If your financial motivation comes in bursts, and “routine” feels like a foreign language, you might be what we call an Adaptive Flowist—a person whose money management ebbs and flows with their energy, attention, or executive function.

It's time to reframe this from laziness or being scatterbrained or however you label it. From this point on, it's rhythm! And when you learn to work with this rhythm, instead of fighting it, budgeting starts to feel less like a shame spiral and more like an adaptive system.

Adaptive Flowist TL;DR

✔ Automate the boring stuff, but keep your hands on the wheel

✔ Schedule sprints, not streaks

✔ Use nudges instead of shame

✔ Protect against gaps with buffers + alert tools

So... what Is an Adaptive Flowist?

You’re locked in one week, Luke Skywalker in the trench about to blow up the Death Star, organizing your transactions, planning how to pay off debts, maybe even rebalancing your investments!

Next week?

You forgot what app you used.

Adaptive Flowists experience cyclical engagement with their money. These cycles often correlate with neurodivergent traits like ADHD, bipolar energy shifts, or even the burnout rhythms of chronic fatigue and executive dysfunction.

Instead of forcing yourself to engage with money every day, your best move is to build a system that works whether you're “on” or not.

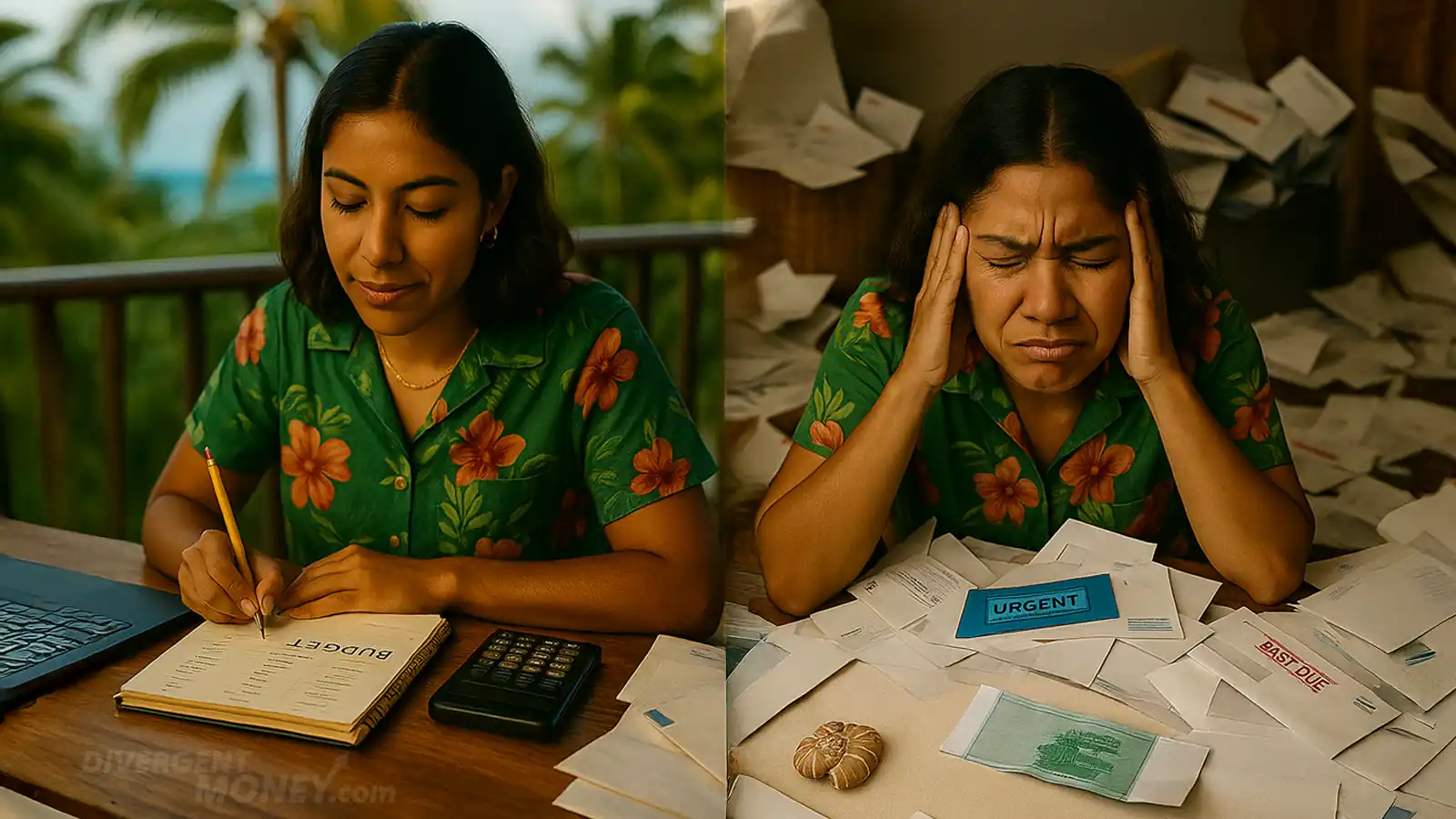

Jess, the OG Flowist

Jess is a freelance designer in Philly. Some months, she’s a financial powerhouse: updating budgets, moving money to her Roth IRA, negotiating her internet bill. Other months? Her unopened mail pile becomes a second piece of furniture. And that's ok.

Her trick? Jess doesn’t force consistency. She designed a "system" (she'll say she stumbled into it while bouncing off walls) that thrives on her bursts of energy and survives the weeks she's checked out.

She engages twice a month, automates the essentials, and keeps a “re-entry checklist” taped inside her cabinet. In two years, she paid off $12k in credit card debt and built a 3-month emergency fund.

Not because she changed who she is. Because she stopped pretending she was someone else.

The 5 Adaptive Flowist Traits

✔️ Can hyper-focus on finances during bursts of energy

✔️ Responds well to flexible tools and non-daily check-ins

✔️ Prefers systems that can “run in the background”

✔️ Often insightful and strategic in short sprints

✔️ Has a strong intuitive sense of when it’s time to re-engage

BUT...

❌ Struggles with consistency

❌ Gets overwhelmed by the idea of “tracking every transaction”

❌ Easily misses bill due dates during disengaged phases

❌ Finds daily habits hard to maintain

❌ Risks financial drift if no fail-safes are in place

Design a System That Matches Your Rhythm

"Most money advice is built for accountants. You’re more like a jazz musician."

Here’s how to architect a quietly resilient, human-centric system that keeps you afloat during your “off” weeks—and capitalizes on your bursts of energy when they hit.

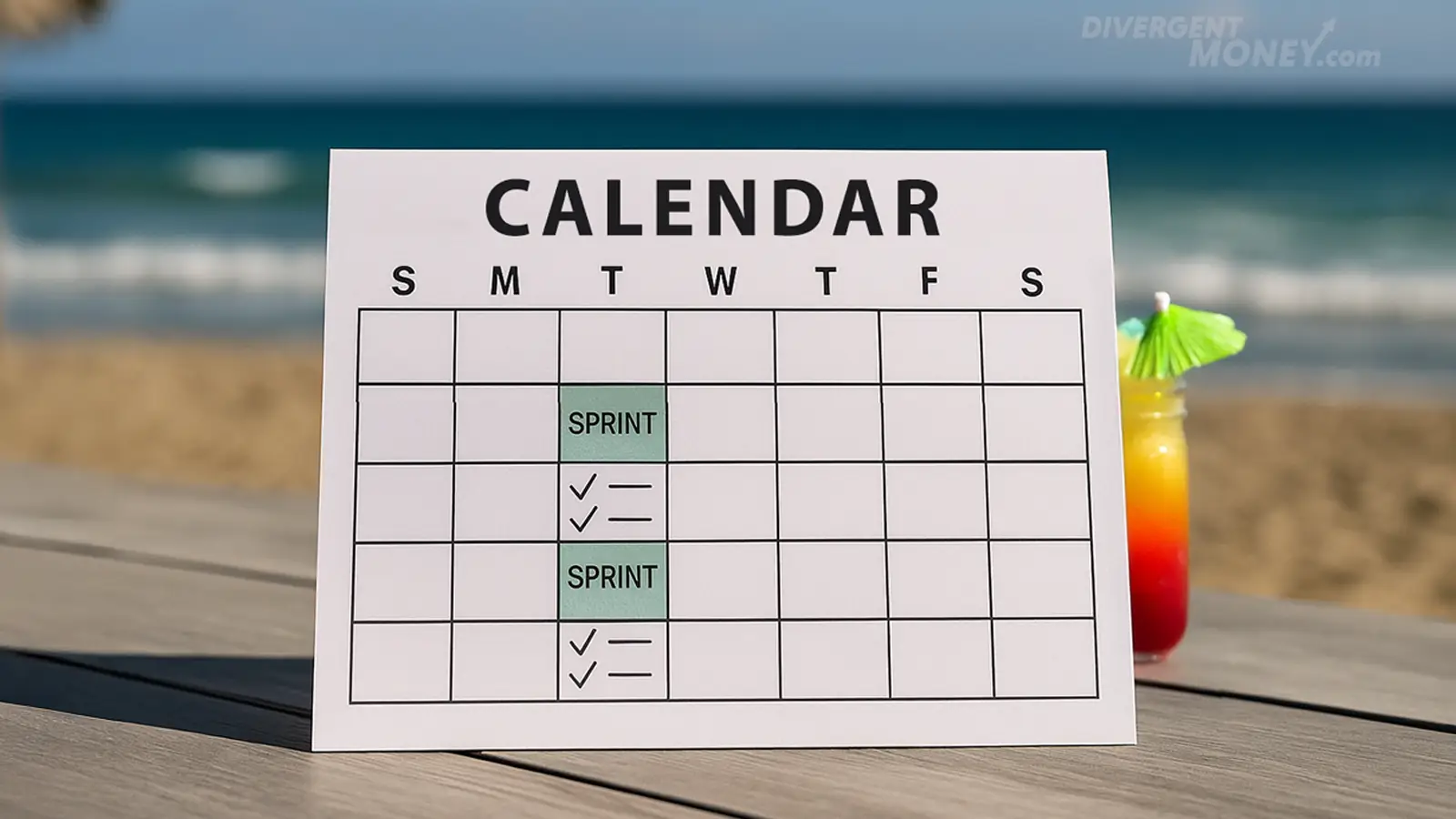

1. Set Up “Financial Sprints” Instead of Daily Tracking

Why it works: Matches your natural flow—short, intense periods of focus.

Do this:

- Pick two fixed check-in days per month (e.g., the 5th and the 20th).

- On those days, review spending, bills, and goals.

- Use tools like Notion, Google Calendar, or even a printed checklist to anchor this ritual.

2. Automate the Basics—With Manual Override

Why it works: Keeps things stable when your energy dips.

Do this:

- Auto-pay for essentials (bills, minimum debt payments).

- Automated transfers to savings or investments.

- Use tools like Rocket Money or YNAB with manual controls.

3. Build a Nudge Layer

Why it works: Even when you’re disengaged, your system taps you on the shoulder.

Do this:

- Set reminders for bills, budget reviews, and transfers.

- Use push alerts and recurring to-dos.

- Name your alerts in a friendly tone. "Budget check-in = Future You high five."

4. Create a Financial Buffer for the Gaps

Why it works: Fills the space between financial bursts.

Do this:

- Build a $500–$1,000 emergency stash

- Use apps to catch missed subscriptions (e.g., Rocket Money)

- Post a simple checklist where you’ll see it: “When I re-engage: 1. Open bank app. 2. Check bills. 3. Breathe.”

The Adaptive Flowist Toolkit

🧠 YNAB (You Need A Budget) – Flexible budgeting without guilt.

🗓 Google Calendar + Notion – Anchor check-ins, add rituals.

🗃 Rocket Money / Truebill – Smart automation that doesn’t bulldoze control.

💸 Auto-Pay + Transfers – Handle the boring parts without thinking.

📲 Friendly Nudges – Let reminders act like post-it notes, not threats.

30-Day Flowist A/B Test

Want to find your rhythm? Run this test:

| Week | Option A (Twice-a-Month) | Option B (Weekly Light Touch) |

|---|---|---|

| 1 | Focused Money Session (aka Deep Sprint) | 15-min budget review |

| 2 | Let automation run | Light review + alerts |

| 3 | 10-min maintenance check | Scan bank app + adjust budget |

| 4 | Full Sprint + prep next month | Weekly planning + micro goals |

Track which one feels more natural. Bonus: Turn it into a Notion tracker or app prototype.

What’s Next?

If you read this far, you’re already thinking differently. And that’s a huge deal.

You don’t need to become the kind of person who checks their budget every day. You need a system that keeps working when you forget it exists.

Want to explore more archetypes? Check out The Divergent Money Matrix. If you feel like money stress makes you avoid everything, you might also relate to The Overstimulate Avoider.

Because financial success isn’t about perfection.

It’s about working with your wiring—and building a system that doesn’t quit when you do.

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.