The $2.4M Reality: Financial Planning for Autism Caregivers

The real cost of lifelong autism care—and how to prepare for itStep-by-step financial moves to make today (even if you're overwhelmed)How Special Needs Trusts, ABLE Accounts, and structured investments actually workWhy caregivers must protect their own retirement and Social Security creditsWhat to do now to prevent crisis later

👉 Whether you’re a parent, partner, or planner—this guide is here to help you play the long game.

📘 Read Time: 7 minutes | For caregivers, autistic adults, and ND allies

When Jennifer realized her son would likely require full-time care for the rest of his life, she froze, "Literally, I could not move." It wasn’t just the emotional weight—it was the math. A lot of it. Housing, therapies, medications, daily routines, caregivers. How do you even begin to plan for a future that doesn’t have an end date? She wasn’t rich. She wasn’t a financial expert. She was just a mom trying to build something that would last longer than she could.

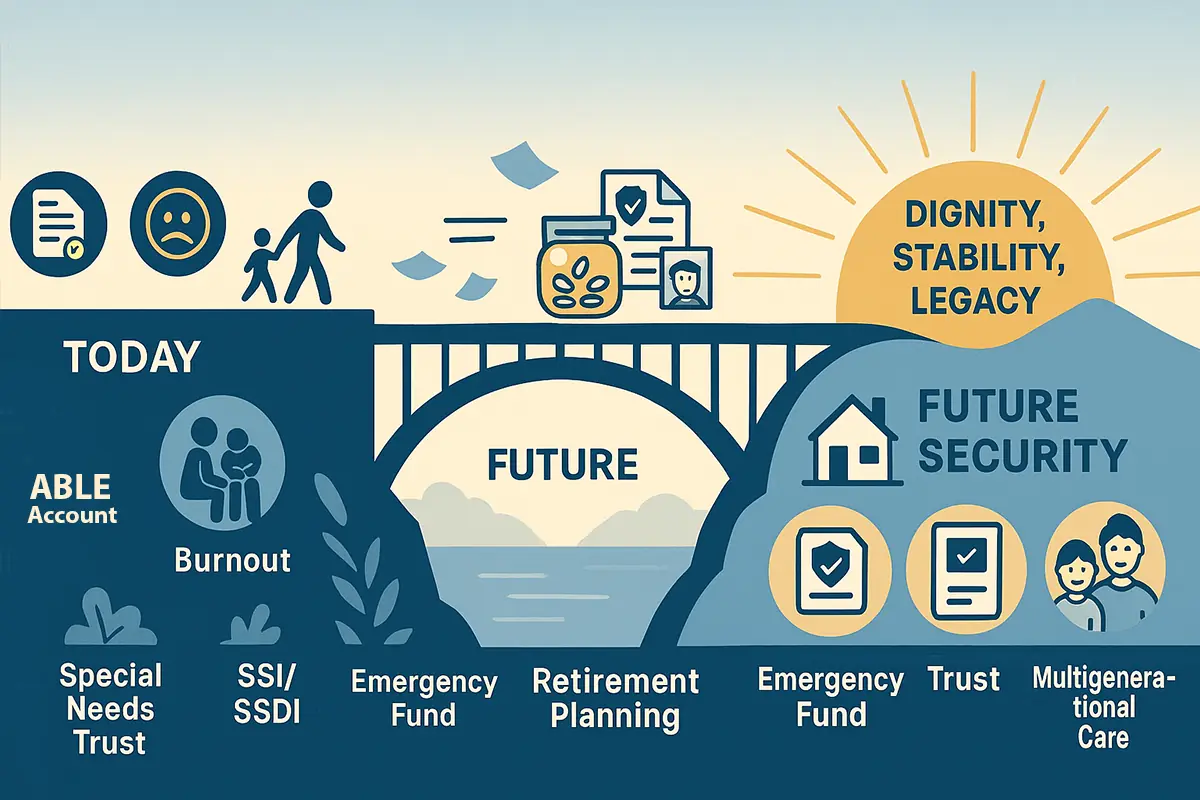

That’s the question facing thousands of families each year. When we talk about financial planning in the neurodivergent community, our minds often jump immediately to short-term solutions—budget hacks, benefits navigation, or crisis-driven triage.

But what about the long-term game? What about ensuring stability and dignity for the people we care about, far into the future?

This isn't just about caregivers of profoundly autistic individuals. It's about all of us. Neurodivergent lives often carry layers of financial precarity: inconsistent income, workforce disruption, costly therapies, and systems that weren’t built for how our brains function. Planning for the future isn’t just wise—it’s survival. Whether you’re autistic, ADHD, dyslexic, or caring for someone who is, the uncertainty of "what happens next" can feel like a looming cliff. Financial planning is how we build a bridge.

Quick Start for Overwhelmed Caregivers

You don’t need to read the whole article right now. Start here:

- ✅ Open a high-yield emergency fund

- ✅ Apply for benefits (SSI, SSDI, Medicaid)

- ✅ Look into ABLE accounts and Special Needs Trusts

- ✅ Keep your own retirement and Social Security in sight

- ✅ Bookmark this for when you have more bandwidth

How to Invest for Long-Term Autism Care: Tools, Trusts, and Strategies

Understanding the Financial Terrain

Caring for a profoundly autistic child—or adult—means balancing daily expenses with decades of future uncertainty. You’re not just paying for today’s therapies or equipment. You’re also planning for housing, guardianship, daily living assistance, and long-term care. And here’s the kicker: these costs don’t decline with age. They often grow.

One common oversight? Underestimating the sheer length and cost of care. Inflation, caregiver burnout, and lost income pile up over decades.

If you're feeling overwhelmed or starting from $0, that’s okay. Start where you are. A small win today—like opening a dedicated savings account or requesting a benefits review—is progress. You don’t have to do it all at once.

What to Do Today

If you're just starting, here’s are a few anchors for you:

- Open a high-yield emergency fund (aim for 6–12 months of expenses)

- Max out free benefits: (In the US) SSI, SSDI, Medicaid

- Talk to a certified special needs financial planner (some work pro bono or via nonprofit programs)

- Keep records of medical, education, and therapy expenses now—it’ll make legal and trust planning easier later

Specialized Financial Tools for Lifelong Care

These aren’t just helpful—they’re critical.

- Special Needs Trusts (SNTs): Protect assets without risking benefits eligibility. Variants include first-party, third-party, and pooled trusts. Each has implications for control, taxes, and longevity.

- Structured Settlements: If you receive a legal or insurance payout, spreading it over years helps preserve benefits and creates predictable income.

- Tailored Insurance Products: Think beyond traditional term life. Products like guaranteed issue policies, survivorship life insurance, and long-term care plans offer layered protection.

👉 ABLE Accounts are another powerful tool—especially for young adults or families with modest assets.

"We almost lost Medicaid coverage because we didn’t realize a small inheritance would count as income. That trust saved us." — Sarah M., caregiver in NY

Traditional Investing With Caregiver Considerations

This isn’t about getting rich. It’s about building resilience.

A caregiver-friendly portfolio often leans conservative. That means bonds, dividend stocks, REITs, and low-volatility funds. You’re looking for low-cost, tax-advantaged vehicles like Roth IRAs, ETFs, and 529 ABLEs. Even small contributions compound over decades.

Your Financial Survival Plan as a Caregiver

It’s easy to disappear into someone else’s needs. But your financial future matters too. Make sure your retirement plan stays intact. Explore options like spousal IRAs or caregiver-specific support programs. If you’re stepping out of the workforce, protect your Social Security credits.

"When I left work to care for my daughter, I didn’t realize I was losing Social Security quarters. It took a toll I didn’t see coming." — Lenora T., former nurse, reader submission

Your well-being is a financial asset. And protecting your income, energy, and health—over years—is the only way this plan works long-term.

Multigenerational Financial Planning

Eventually, every caregiver asks: “What happens when I’m gone?”

Start early with legal designations—guardianship, powers of attorney, successor trustees. Revisit your will every 3–5 years. Host family planning meetings. If no one else can take over, research state-managed support systems, housing cooperatives, or long-term residential communities now—not when crisis hits.

TL;DR: The Caregiver's Long-Term Finance Plan

- ✅ $2.4M = average lifetime autism care cost (source: Urban Institute + Autism Society, 2022)

- ✅ Use Special Needs Trusts and ABLE accounts to preserve benefits

- ✅ Caregivers must protect their own retirement & Social Security credits

- ✅ Structured investments and conservative portfolios build resilience

- ✅ Planning now prevents crisis later

Expert Advice, Surprising Facts & Real-Life Examples

Here’s a staggering but well-documented truth: A 2022 report by the Autism Society and the Urban Institute found the average lifetime cost of care for an individual with autism and intellectual disability exceeds $2.4 million.

That number isn’t just staggering—it’s clarifying. It shows why planning isn’t a luxury. It’s a necessity.

Practical Next Steps & Resources

Here’s what to do now:

- Review or initiate your emergency fund.

- Talk to a financial advisor who works with special needs families.

- Maximize government resources (SSI, SSDI, Medicaid).

- Begin planning for multigenerational care.

Use our neurodivergent glossary to demystify complex financial terms as you go.

COMING SOON: How to Fund an ABLE Account When You’re Broke

FAQ: Caregiver Finance Questions

What is a Special Needs Trust?

A legal structure that protects a disabled individual’s access to public benefits while allowing assets to be used for supplemental needs.

How much does it cost to care for an autistic adult long term?

Studies suggest $2.4M across a lifetime—mainly due to housing, therapies, and caregiving.

Can I save for my autistic child without losing SSI eligibility?

Yes. ABLE Accounts and properly structured trusts can preserve benefits while allowing savings.

What happens to my child if something happens to me?

You need to designate guardianship, successor trustees, and ensure your estate plan is up to date.

Playing the Long Game

The deepest truth at the heart of financial planning for profound autism—and indeed all neurodivergent lives—is this: planning buys dignity. It creates possibility. It gives structure to love.

You are not alone in this. But you do have to start.

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.