Rocket Money vs CoPilot Money: Which Saves More in 2025? (Real User Results + QUIZ)

The "best" app depends entirely on how your brain works with money.

"I either go full spreadsheet samurai with my subscriptions... or I ghost my bank account for three weeks."

Sound familiar?

Sarah canceled 9 subscriptions with Rocket Money and saved $257 in her first month. Mike used CoPilot Money's methodical approach and saved $1,200 over six months. Tom tried the DIY route and... well, he's still paying for that "free" trial from 2019. These stories show the spectrum: quick wins, sustainable change, and total drift.

The "best" app depends entirely on how your brain works with money. And choosing wrong can actually cost you more.

[Newsletter CTA] Before we dive in: Get our free 'Money Style Assessment' and find out which apps actually match how you think about money. Join 15,000+ readers getting smarter about personal finance.

The Bottom Line Up Front

🚀 Choose Rocket Money if you:

- Have 5+ subscriptions

- Prefer “handle it for me” solutions

- Value time over learning

- Can afford $6–12/month

🧭 Choose CoPilot Money if you:

- Want to understand your money patterns

- Enjoy hands-on planning

- Are building toward major goals

- Can afford $13/month consistently

⚖️ Choose neither if:

- You have under 3 subscriptions

- Are tight on money

- Prefer free alternatives

⛔ The uncomfortable truth:

Both apps assume you have $100+ in “subscription bloat” and disposable income for tools.

If money’s genuinely tight, scroll down for our free alternatives section.

Now, let's unpack why your choice matters more than you think.

Quick Reality Check: What You're Actually Choosing Between

| The "Handle It For Me" Approach | The "Show Me How" Approach |

|---|---|

| Rocket Money | CoPilot Money |

| $6-12/month (you choose) | $13/month or $95/year |

| "We'll call and cancel for you" | "Here's exactly how to do it" |

| Automated concierge service | Guided self-service approach |

| Best for: Busy delegators | Best for: Control enthusiasts |

| Risk: Learn nothing | Risk: Requires effort |

Your Money Management Style (This Determines Everything)

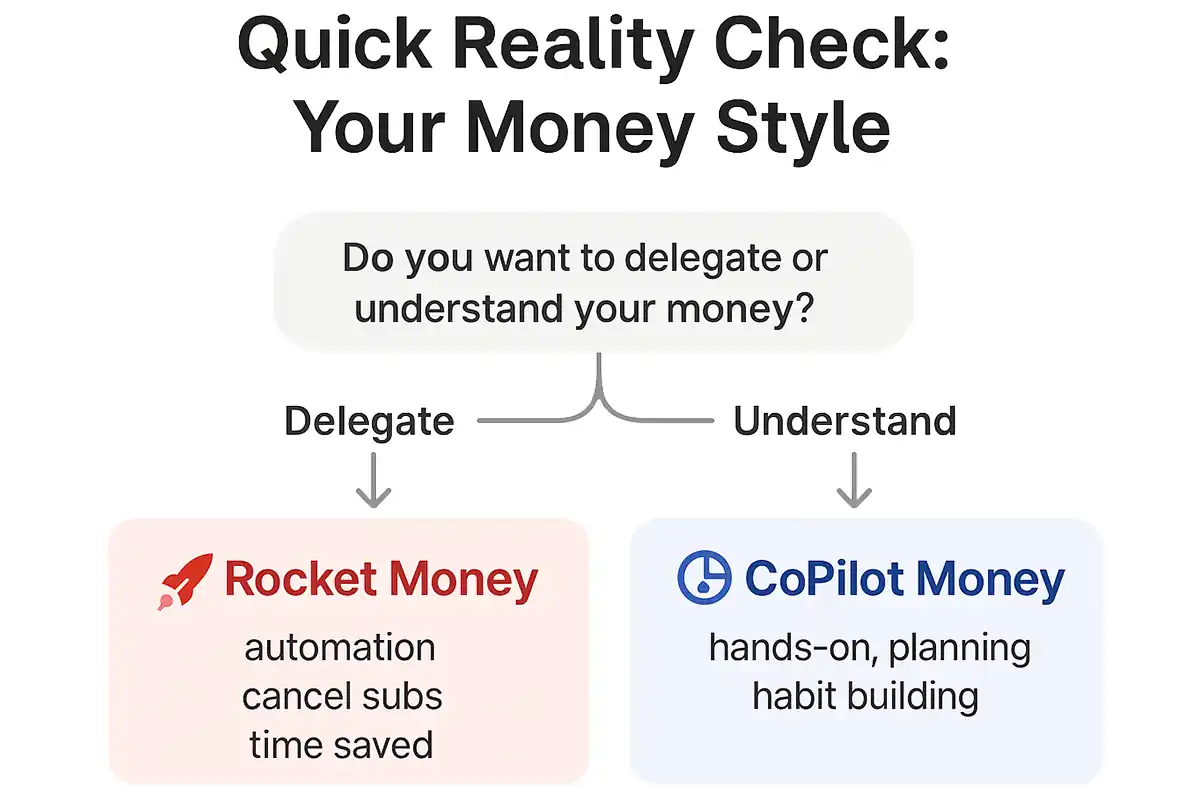

Quick self-assessment—which sounds more like you?

When facing a money problem:

- A) "Someone else should handle this" → Rocket Money

- B) "I want to understand how this works" → CoPilot Money

Your ideal approach:

- A) Automated and hands-off → Rocket Money

- B) Engaged planning and tracking → CoPilot Money

When you overspend:

- A) "Stop me next time" → Rocket Money

- B) "Help me understand why" → CoPilot Money

Mostly A's? You're wired for delegation. Mostly B's? You're wired for understanding. Mixed results? You might need both apps, or neither is quite right for you.

Want a deeper analysis? Our 'Money Personality Deep Dive' (newsletter subscribers only) reveals which specific features matter for your cognitive style.

The Real Costs (Beyond Marketing Fluff)

Rocket Money's flexible pricing:

- Choose what you pay: $6-12/month

- 7-day free trial included

- Bill negotiation fees: 35-60% of your first year's savings (you choose the percentage, paid upfront)

CoPilot Money's straightforward deal:

- $13/month or $95/year ($7.92/month annually)

- No hidden fees or complicated pricing

- 30-day free trial available

- Includes unlimited guidance for subscription cancellations

The math: For pure subscription management, if you're canceling many services, the approaches cost roughly the same. CoPilot Money's annual plan ($7.92/month) often costs less than Rocket Money's average pricing.

What Real Users Actually Say

Sarah (Rocket Money): "Saved me $347 in month one when they canceled subscriptions I'd forgotten about. Six months later though, I was back to the same habits because I never learned why I keep signing up for things."

Mike (CoPilot Money): "Took more effort initially and I had to make some phone calls myself, but now I actually understand my spending patterns. Haven't had subscription creep since."

Tom never canceled— proof that DIY only works if you actually do it.

From our research with users Rocket Money users love the immediate results but sometimes struggle with long-term habit change. CoPilot Money users report more sustainable improvements but need higher initial engagement.

Beyond Cancellations: Which Actually Changes Your Money Life?

Rocket Money's strength: Stops financial bleeding through automation. Bill negotiation service, credit monitoring, net worth tracking. Best for maintenance mode.

CoPilot Money's strength: Builds financial understanding through guided learning. Zero-based budgeting, goal planning, spending analysis with AI-powered insights. Best for growth mode.

Track records: Rocket reports $2.5B saved; CoPilot wins Apple awards.

Key difference: Rocket Money creates good subscription habits. CoPilot Money focuses on comprehensive money management skills.

When Money Is Actually Tight (The Real Talk Section)

Let's be honest: $8-15/month isn't trivial for everyone. If you're genuinely struggling financially, aka "survival budgeting," skip the apps. Focus on bills, food, housing first.”

Free alternatives that work:

- For subscription tracking: Spreadsheet + calendar reminders

- For budgeting: Mint (ending soon), YNAB free trial, EveryDollar free version

- For cancellations: use online guides and phone scripts, ChatGPT, Gemini, etc. can help craft phone script for you to use as well.

The harsh reality: If you can't comfortably afford the app fee, you might not have enough subscription bloat to justify either service.

When to consider paid tools: When you're spending $50+ monthly on subscriptions you don't actively use, or when you've tried free methods and keep falling back into old patterns.

Tight budget? Join Divergent Money for FREE today. Get updates whenever we post new articles and resources AND join out weekly newsletter on Substack. Click below 👇

Our contrarian take: The best money app is the one you'll actually use for 6+ months. Features matter less than building sustainable habits that match how you think.

QUIZ: Which Money App Fits Your Brain?

FAQ: Your Real Questions

Q: What's the actual success rate for canceling subscriptions? A: Both apps can cancel most common subscriptions, but success varies by service. Neither publishes comprehensive success rate data.

Q: Are the savings claims realistic? A: Rocket Money's $2.5 billion figure includes all member activities over 5+ years. Individual results vary widely based on your starting subscription load.

Q: What if I try one and hate it? A: Both cancel easily through app settings. Try CoPilot's free trial first—worst case, you learn about your money style.

Q: Can I really not just do this myself? A: Yes, but if DIY worked for you, you wouldn’t be here. (Hugs in advance!)

Q: Which works better for couples? A: CoPilot Money has specific couples features. Rocket Money focuses on individual accounts but can be shared.

Q: Do these actually work or just enable bad habits? A: Both can work, but they address different problems. Rocket Money excels at stopping current bleeding; CoPilot Money focuses on preventing future issues through understanding.

Ready to Find Your Match?

Choose based on how you naturally think about money, not just feature lists. (Marketers LOVE to add features so products seems like a great deal!)

Take our Money Style Assessment to get a personalized recommendation based on your cognitive patterns, budget reality, and financial goals.

This article contains no affiliate links. Our recommendations are based on independent testing focused on helping you find tools that match how you think about money. Pricing and features verified as of September/October 2025.

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.