The ADHD Health Trifecta: Why Physical, Mental, and Financial Health Are Inseparable

ADHD isn’t just about distraction—it’s a full-body experience that affects how we live, spend, work, and stay well. The cost of not treating it seriously? Up to 13 years off your life.

This is your ADHD health trifecta: physical, mental, and financial health. Understand how they connect, and you’ll unlock momentum instead of burnout.

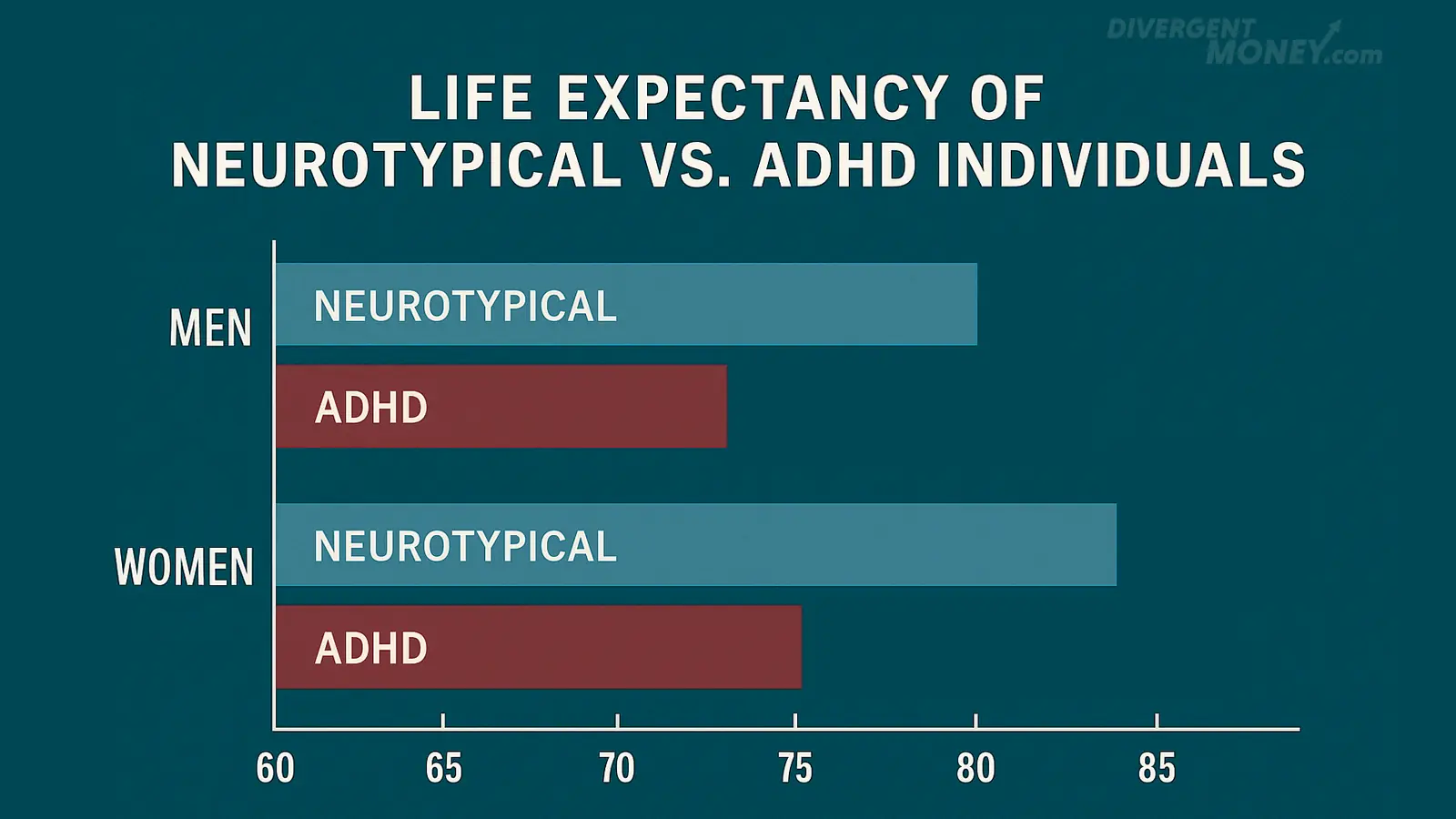

Does ADHD Really Lower Your Life Expectancy?

Yes—and the numbers are sobering.

People with ADHD are more than twice as likely to die prematurely, according to research in The Lancet. Men lose an average of 6.8 years; women, 8.6. A Danish study following over 2 million people confirmed the risk climbs even higher when ADHD is paired with other psychiatric conditions. And Dr. Russell Barkley’s landmark longitudinal research? A potential 13-year gap.

But this isn’t just about statistics, it’s about support systems. When ADHD is unrecognized or untreated, it snowballs into compounding risks: more accidents, fewer medical checkups, missed diagnoses, and mental health challenges that go unchecked.

Top causes? Accidents, unmanaged health, and untreated mental illness.

If you only remember one thing: The danger isn’t ADHD. It’s pretending it doesn’t matter.

Executive Dysfunction: The Silent Saboteur

This is the bottleneck. Executive dysfunction doesn’t shout—it whispers. It’s the quiet force behind why everything feels harder than it should. ADHD disrupts the systems we rely on to do life: planning, impulse control, working memory, and follow-through.

Ever feel like you’ve already failed before you even begin? That’s a breakdown in the brain’s ability to initiate and sequence tasks. It’s why you might forget to pay a bill, even while stressing about it constantly. Why a great idea never makes it to execution. Why the day ends and you can’t quite explain where the time went.

Executive dysfunction is neurological friction. And once you name it, you can build friction-reducing systems around it.

It’s the invisible tax on your time, health, and finances. It’s the reason small tasks balloon into shame spirals. And it’s the thread tying together skipped doctor’s appointments, chaotic eating and sleep habits, and abandoned budgets.

It’s not a motivation problem. It’s a brain-function bottleneck.

Quick Fix: Start with just one external system (a calendar, a daily alarm, a budget app). Don't stack. Just start.

Mental Health: The Bedrock of the Trifecta

ADHD rarely travels alone. Anxiety, depression, and substance use often tag along. And when mental health dips, so does your ability to care for your body or manage your money.

What helps:

- CBT to challenge thought traps

- Mindfulness to regulate emotions

- Medication when clinically appropriate

- Body doubling or ND peer support to build momentum

Try this: Add a "mental health checkpoint" to your weekly budget review.

Want more? Read: Budgeting Advice From Another Planet.

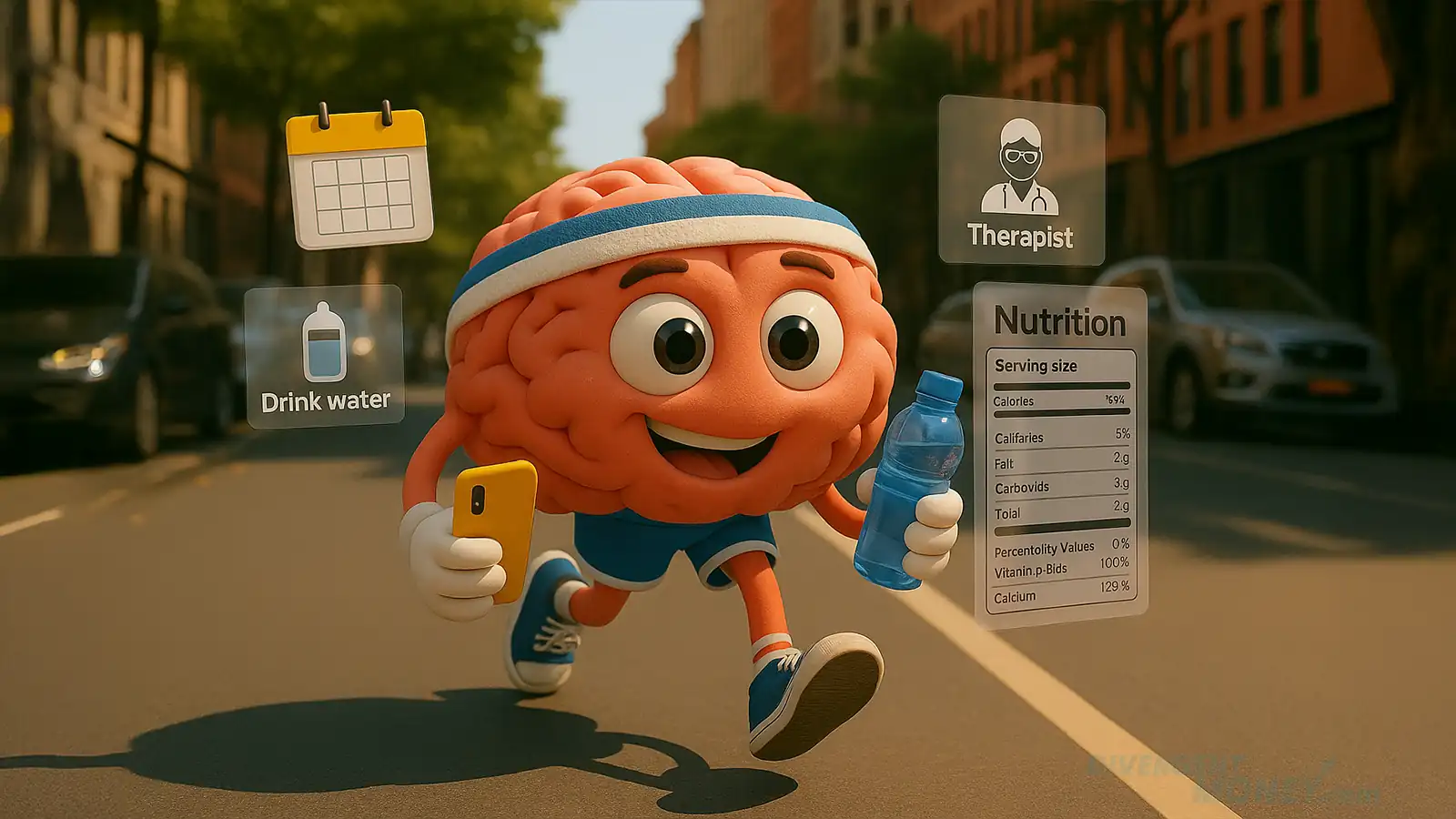

Physical Health: Where ADHD Hits Hard

ADHD impacts physical health in sneaky ways:

It’s not just the dramatic stuff—it’s the slow erosion of well-being that builds up when executive function misfires. You don’t notice the dehydration until the headache hits. You forget a meal, then overeat at midnight. You promise to schedule that checkup... but weeks pass.

The impact is cumulative, not cataclysmic. And that’s exactly what makes it dangerous. Physical health slips through the cracks of distraction, time blindness, and mental fatigue. Over time, what feels like a small compromise becomes a major health issue. When we stop framing it as a willpower issue and start seeing it as a systems mismatch, things start to click.

- Impulsivity = injury

- Time blindness = skipped meals (or four midnight ones)

- Low motivation = no workouts

Solutions that work:

- Accountability systems (apps, partners, visual cues)

- Stimulating, structured movement (dance, martial arts, resistance training)

- Habit stacking: Link movement to something you already do

One-minute win: Walk in place while brushing your teeth. You’re stacking.

Financial Health: The ADHD Pressure Cooker

ADHD often shows up in your bank account first. Before a diagnosis, before a formal plan, the financial warning signs are already flashing: impulse buys that feel like relief in the moment, missed bills that stack up into shame, unopened mail that becomes a source of dread. These are cognitive mismatches. Our financial systems reward consistency and executive function, two things ADHD disrupts. It’s not just about money. It’s about how money reflects overwhelm, time blindness, and internal chaos in a world that expects none of that. Sound familiar??

Instead of shame, try strategy:

- Automate everything: bills, savings, even reminders

- Use visual-first tools (like YNAB or Qube)

- Break it down into 5-minute wins

Money move: Set a 5-minute timer and delete old subscriptions. That’s a win.

More strategies here: Stack the Wins to Improve Motivation.

The ADHD Success Stack: What Actually Works

To thrive with ADHD, you can’t treat physical, mental, and financial health as separate to-do lists. They feed off each other. When one breaks down, the others wobble. But when they align? That’s when real progress sticks.

Think of it as a loop, not a ladder.

To thrive with ADHD, treat the trifecta like one ecosystem:

- Diagnose early: Adult ADHD is real, common, and treatable

- Go holistic: Mix meds, therapy, movement, nutrition, coaching

- Normalize your toolkit: Apps, alarms, checklists = cognitive prosthetics

- Change the environment: Ask for accommodations, simplify systems

- Speak up: Share your experience to lower the stigma

Visual aid idea: [Trifecta Venn Diagram: Physical / Mental / Financial Health Overlap]

So Hit the Road!

The real danger isn’t ADHD. It’s neglecting to treat it.

When we silo mental, physical, and financial health, we miss the compounding effects of care—and the cost of neglect.

This is a call to integrate.

ADHD deserves full-spectrum support. And when we build systems for neurodivergent brains, we make life better for everyone, including all aspects of you.

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.