Job Hunting while Neurodivergent - Part 4 of 5

Stability in the Storm: Navigating Financial Uncertainty During Unemployment

Read the full series → Part 1 | Part 2 | Part 3 | Part 5 (coming soon)

Losing a job can feel like you’ve been dropped into a storm without a map. The financial stress alone is enough to trigger shutdown. For neurodivergent individuals, executive dysfunction, sensory overload, and emotional dysregulation can magnify the chaos. But even in that fog, a new path is possible.

This guide walks you through the most urgent next step: regaining financial stability while unemployed. If you feel frozen, you're not alone—and you're not out of options.

Take Inventory: What’s Your Current Financial Reality?

[IMAGE PROMPT: A digital collage showing highlighted bank statements, sticky notes, and a budgeting app screenshot on a phone. Include hand-drawn arrows and categories like "ESSENTIAL" and "CAN CANCEL" to visually suggest sorting.]

Before you plan anything, you need a clear view of where things stand.

- Review income, expenses, and savings

- Bank accounts, credit cards, subscriptions, loans.

- Essentials vs. discretionary spending.

- How long can you sustain current spending levels?

Tip: Use a visual budgeting app like YNAB, Monarch, or even color-coded Google Sheets. Make your financial picture visible.

- Prioritize Essentials

Focus your limited resources:- Housing, food, utilities, medications.

- Pause or cancel what’s non-essential (streaming, delivery, upgrades).

- Contact service providers—many offer hardship deferments.

Tip: Call before you're behind. Scripts help. Try: "I'm navigating temporary unemployment. Do you have a hardship or payment pause option available?"

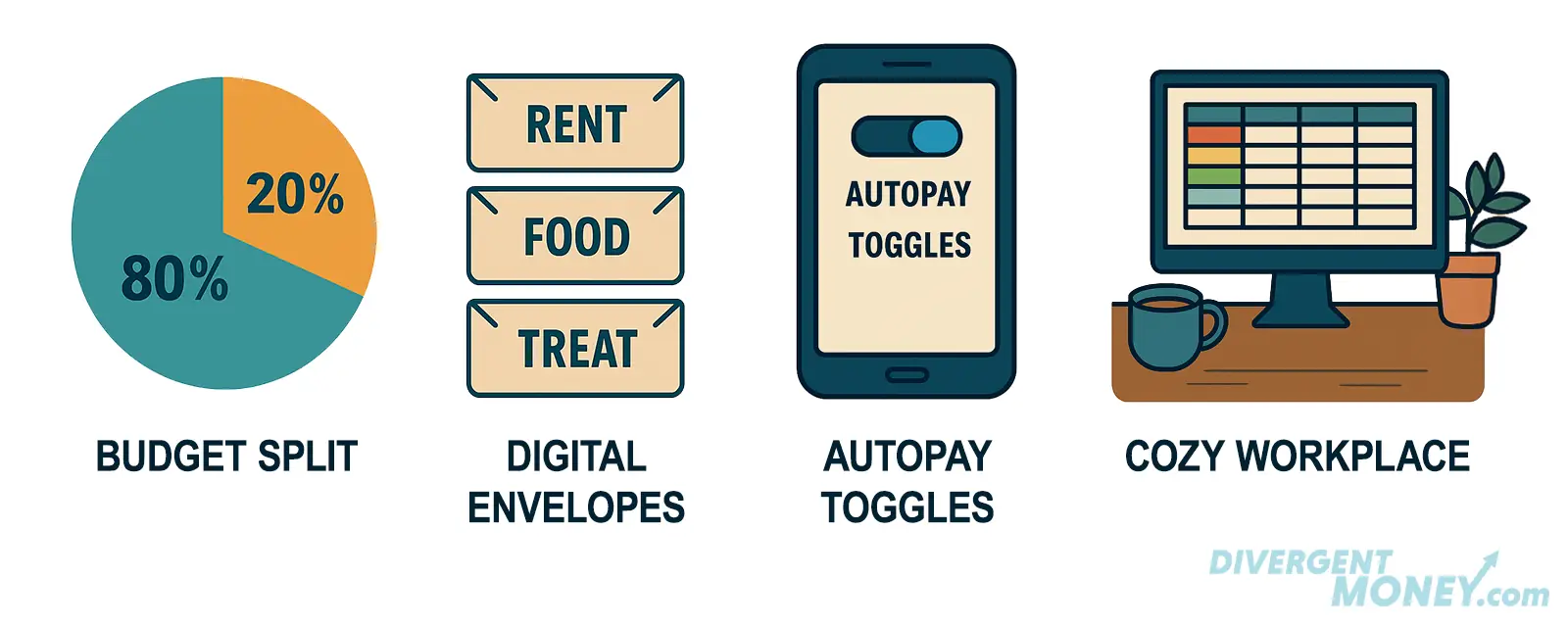

Neurodivergent-Friendly Budgeting Tools and Tips

Neurotypical budget systems often fail because they weren’t designed for divergent thinking.

- Try a Simplified Rule (80/20 or Envelope Style)

- 80% of funds = survival needs, 20% = discretionary.

- Use envelope-style categories—physical or digital—to reinforce boundaries.

- Reduce Decision Fatigue with Automation

- Autopay for bills to avoid late fees.

- Set low-balance alerts, spending limits, or transaction nudges.

- Build in Small Wins

- Rigid budgets fail under pressure.

- Give yourself a $5–10 “treat fund” to maintain a sense of autonomy and reward.

Tip: Pair budget reviews with sensory positives—a warm drink, music, or weighted blanket.

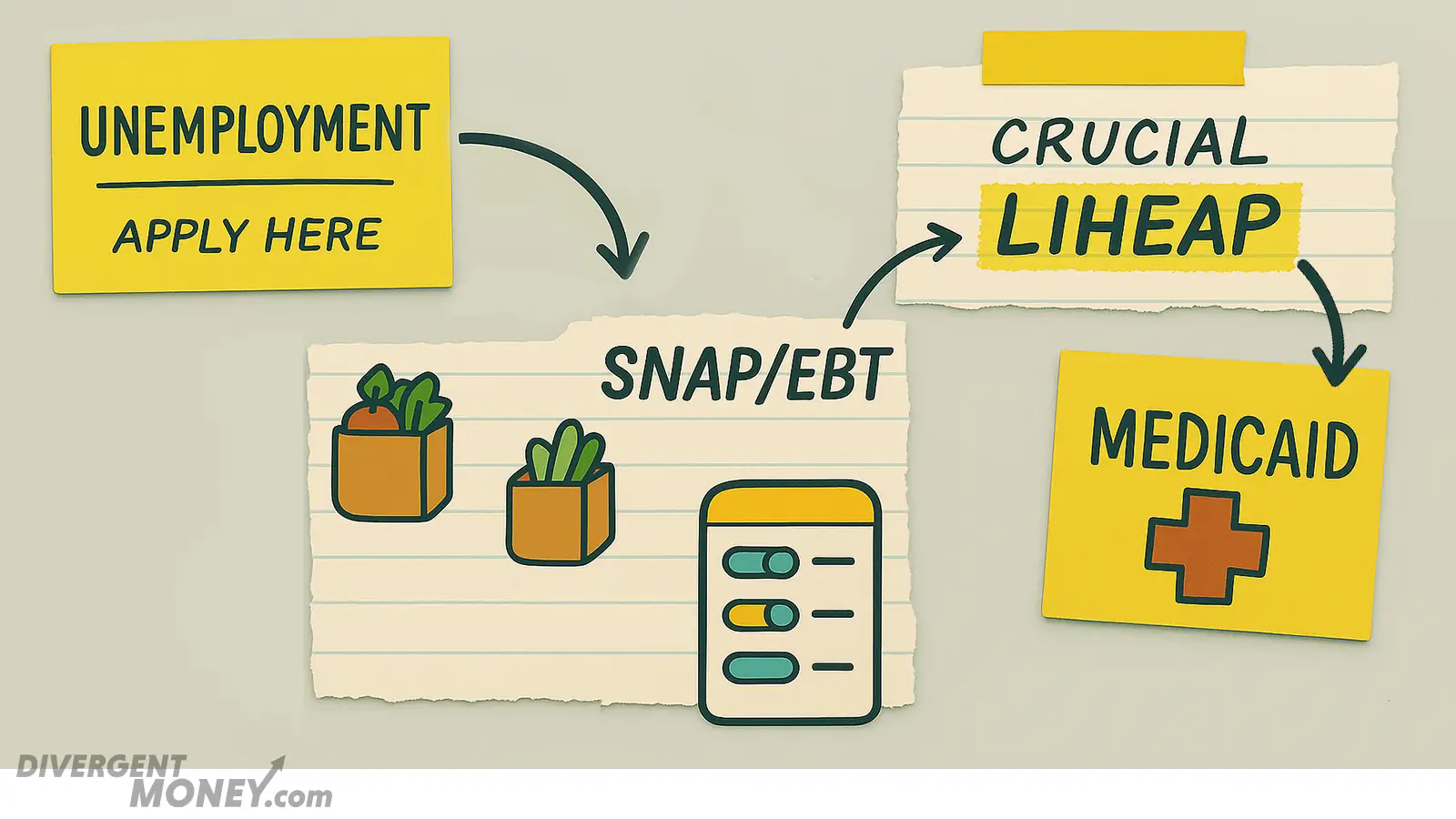

Tap Into Financial Support Systems

There is help, even if accessing it feels hard. These are specific steps for our US readers, each country and region will have their own. Please share what you find with us!

- Apply for Unemployment ASAP

- Each state differs. Apply even if you’re unsure of eligibility.

- Keep job search logs and check in weekly to maintain benefits.

- Explore Assistance You May Qualify For

- Food: SNAP (EBT) or local food banks.

- Utilities: LIHEAP or local energy grants.

- Healthcare: Medicaid or ACA marketplace.

Tip: Visit 211.org for localized resources in housing, mental health, and more.

- Consider Temporary or Gig Work

- Freelance platforms like Upwork, TaskRabbit, or Rev.

- Neurodivergent strengths often shine in focused, short-term roles.

Mental Health During Financial Instability

- Reframe the Experience

- This isn’t failure. It’s disruption. Temporary and survivable.

- You are not behind—you are recalibrating.

- Control the Frequency of Financial Check-Ins

- Obsessive tracking spikes anxiety.

- Choose one day a week to review everything.

- Seek Support Without Shame

- Financial stress is isolating. Shame thrives in silence.

- Look for ND-friendly financial groups or job forums (try Reddit, Facebook, or Discord communities).

Steadying the Ship

Financial uncertainty is unsettling, but by implementing a structured plan, seeking available resources, and managing stress effectively, you can navigate this period with resilience.

Stability isn’t the end goal—it’s the platform for reinvention. In the next part of this series, we’ll help you rebuild confidence, clarify your next steps, and move forward with purpose.

Revisit Earlier Parts of the Series: