Glossary: Microtrauma

Microtraumas are the moments that feel like nothing— until they feel like everything.

Microtrauma

noun | "small hits, big impact"

Quick Start: 3 Ways Microtrauma Affects Your Finances

- You avoid budgeting not because you're lazy—but because it's tied to repeated stress.

- Executive dysfunction isn’t the problem—it’s the result of cumulative emotional strain.

- You can rebuild your financial confidence with ND-friendly systems that work with your brain.

In everyday terms:

Microtraumas are the moments that feel like nothing—until they feel like everything. They’re the offhand comments, the side-eyes, the group messages you get left out of. They’re the tiny failures to launch: the unopened emails, the 47 tabs you couldn’t bear to close, the budget spreadsheet you ghosted after one week.

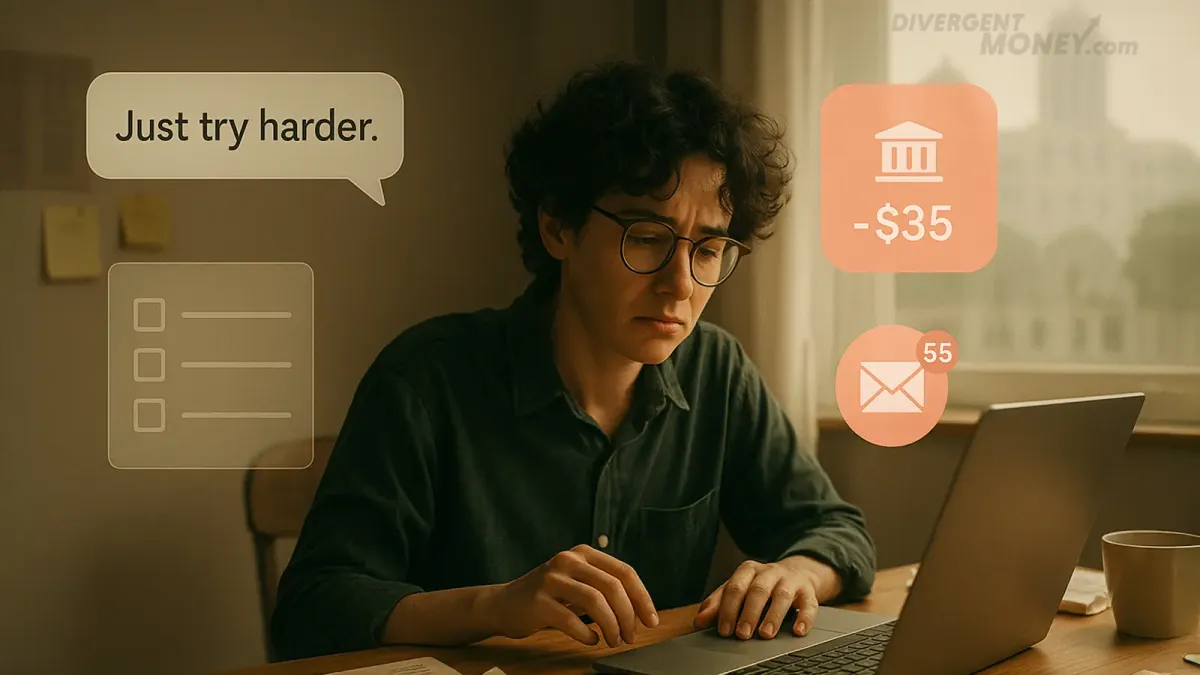

Especially if you’re neurodivergent, these hits accumulate. You get told to “just try harder,” punished for how your brain naturally works, or shamed for financial habits you never had the tools to regulate. Alone, these moments are forgettable. Together, they’re exhausting. You end up carrying a weight you can’t name—but it drags your motivation, your focus, and your finances down with it.

📎 Related: Executive Dysfunction & Avoidance

Clinically speaking:

Microtrauma refers to the cumulative psychological impact of repeated, low-intensity stressors. These aren’t major traumatic events—but chronic, unresolved moments of social invalidation, cognitive overwhelm, and systemic friction that gradually dysregulate the nervous system. In neurodivergent individuals, microtraumas often go unrecognized but manifest somatically and behaviorally: through emotional shutdowns, financial avoidance, executive dysfunction, or a persistent sense of failure. Over time, they can contribute to burnout, depression, and trauma responses typically associated with complex PTSD.

How Microtraumas Affect Personal Finance:

Financial microtraumas are real— and for neurodivergent folks, they often start early.

- Getting punished for forgetting lunch money.

- Being told "money doesn't grow on trees" when you didn’t understand how budgeting worked.

- Masking your confusion in a bank appointment so you wouldn’t seem "dumb."

As adults, it compounds:

- You freeze when it’s time to open your budgeting app.

- You avoid checking your bank balance for fear of confirming a failure.

- You promise to "start fresh next week"—for the twelfth time.

These aren’t just emotional reactions. They’re patterned behaviors rooted in real, repeated harm. When money management has always felt like a minefield, your brain learns to flinch. That flinch turns into financial paralysis, perfectionism, or hypervigilance. And most budgeting advice? It doesn’t address the root. It just reinforces the shame. (Related: The Security Seeker: How to Budget When Uncertainty Sends You Into a Spiral)

And if you’re ND and dealing with poverty, systemic discrimination, or disability, these hits aren’t just emotional—they’re logistical barriers that compound over time. The systems themselves—banking institutions, predatory lenders, welfare bureaucracy, inaccessible websites, and medical gaslighting—are frequent sources of microtrauma. It’s not just about shame. It’s about survival in systems that were never designed to include you.

What Helps:

✅ Micro-boundaries for Microtraumas: Learn to say "I’ll do this in 10 minutes" instead of "I have to fix everything now."

✅ Use ritual, not willpower: Pair budget check-ins with something comforting (tea, stim toy, playlist).

✅ Name it to reclaim it: Track financial microtraumas in a journal or voice memo. Pattern = power.

✅ Create ND-safe resets: Build systems with soft landings. Try: Reset Weeks, friction-free re-entry plans, or shared financial calendars with ND-friendly visuals.

✅ Seek repair, not perfection: You’re not trying to become a spreadsheet machine. You’re trying to build a life you can live inside, financially and emotionally. (See also: Stack the Wins)

🧠 Struggling with resets? Start with our Reset Week system.

TL;DR:

Microtraumas are the hidden cost of existing in a world that wasn’t built for your brain—and they shape your relationship with money more than you think. But once you see the pattern, you can break it. You are not bad at money. You’ve just been surviving a system that kept bruising you. It’s time to budget like someone who deserves ease.

🗣️ Shareable Insight: “You’ve just been surviving a financial system that kept bruising you.”

FAQ

Q: What does financial microtrauma look like?

A: It can look like procrastinating on bills, avoiding your budget dashboard, freezing during financial conversations, or feeling like you're always "behind" even when you're trying. It might not seem like trauma—but if money triggers a stress or shutdown response, microtraumas could be at play. (Also see: Fixing Your Credit Without Meltdowns)

Internal Links:

- See also: Financial Trauma

- Reset Week: The ADHD Budgeting Hack

- Executive Dysfunction & Avoidance

- Don’t Kill the Goose: Burnout-Proof Budgeting

- Financial Strategies for Your Divergent Money Type

- Stack the Wins

- Fixing Your Credit Without Meltdowns

- The Security Seeker

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.