Financial Strategies for Your Divergent Money Type

Over the next few weeks we'll be adding focused guides for each type in the Divergent Money Matrix. Stay tuned!

In the meantime, if you haven't taken the quiz yet...

🛠 The Systems Hacker

Core Pattern: Creates perfect financial systems but struggles with consistent implementation.

Real Example: Michael spent 12 hours building an elaborate financial tracking spreadsheet—then never opened it again after the initial setup. He has extensive financial knowledge but minimal follow-through.

Key Strategy: Focus on simple systems with automated implementation rather than perfect design.

🔥 The Idea Alchemist

Core Pattern: Brilliant at generating income opportunities but inconsistent with financial management.

Real Example: Sophia easily launches creative side hustles but often forgets to send invoices or set aside money for taxes. She's simultaneously financially abundant and chaotic.

Key Strategy: Create automated systems that immediately route incoming money to appropriate tax, savings, and spending accounts.

🌊 The Visual Navigator

Core Pattern: Processes financial information visually rather than through numbers or text.

Real Example: Aiden couldn't stick with any budgeting system until finding one with color-coded categories and graphical interfaces. Text-heavy financial statements overwhelm him completely.

Key Strategy: Use highly visual financial tools with color-coding, charts, and minimal text.

🍃 The Adaptive Flowist

Core Pattern: Works in intense bursts of financial productivity followed by minimal engagement.

Real Example: Lin brilliantly manages money during "on" periods but leaves bills unopened during low-energy phases. Her financial system needs to accommodate these natural cycles.

Key Strategy: Build financial buffer zones and automation that maintain stability during low-energy periods.

🏰 The Security Seeker

Core Pattern: Needs clear rules and predictability to feel financially safe.

Real Example: James experiences anxiety around financial uncertainty and thrives with clearly defined systems. Unexpected expenses or decisions without guidelines create significant stress.

Key Strategy: Create detailed financial policies and scheduled reviews that provide structure and reassurance.

🫠 The Overstimulated Avoider

Core Pattern: Becomes overwhelmed by financial complexity and shuts down completely.

Real Example: Mei finds financial apps visually overwhelming. Multiple accounts, transaction histories, and notification alerts cause genuine sensory overload and mental shutdown.

Key Strategy: Choose minimal-interface financial tools and create sensory-friendly environments for money management.

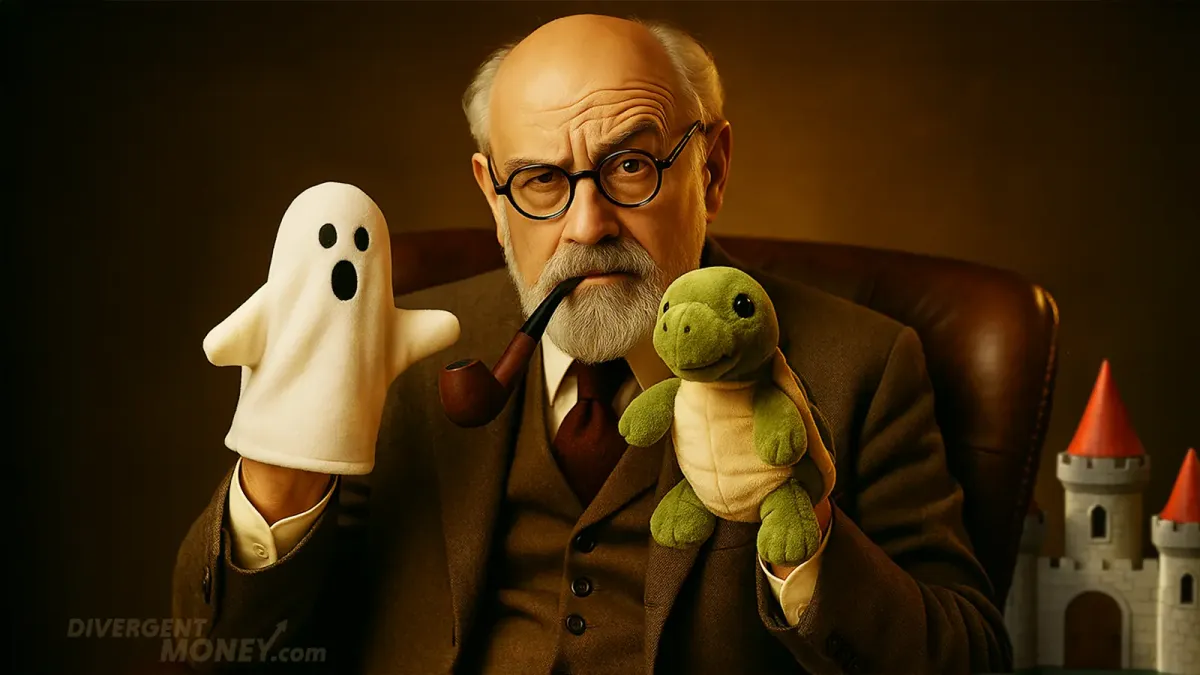

🐢 The Turtle

Core Pattern: Retreats from financial reality due to shame, anxiety, or overwhelm.

Real Example: David hasn't opened bank statements in six months. What started as avoiding one overdraft notice snowballed into complete financial avoidance and mounting shame.

Key Strategy: Create a gradual, shame-free re-entry plan with tiny financial engagement steps.

🎉 The Party Animal

Core Pattern: Lives in the moment financially, prioritizing experiences over planning.

Real Example: Carlos spends spontaneously on social activities but often lacks funds for essentials because he hasn't built savings habits that accommodate his spontaneous nature.

Key Strategy: Implement "pay yourself first" automation that happens before discretionary spending opportunities arise.

🧩 The Chaotic Juggler

Core Pattern: Manages multiple complex financial streams but periodically drops critical elements.

Real Example: Amara successfully handles various income sources and accounts—until sudden catastrophic oversight, like completely forgetting tax deadlines despite having sufficient funds.

Key Strategy: Create a central financial dashboard with triple-redundant reminders for critical deadlines.

🌀 The Overthinker

Core Pattern: Gets stuck in analysis paralysis with financial decisions.

Real Example: Sam researches financial options exhaustively but struggles to actually implement choices, losing valuable time while seeking the "perfect" solution.

Key Strategy: Establish clear decision criteria, time limits, and implementation partnerships.

🐇 The Financial Rabbit

Core Pattern: Jumps between financial systems, never staying with one approach long enough to see results.

Real Example: Elena tries every new budgeting system she discovers with initial enthusiasm but gets bored before any system becomes habitual, creating a cycle of financial false starts.

Key Strategy: Build a stable automated core that remains consistent while allowing for periodic "refresh" of interfaces and approaches.

👻 The Money Ghost

Core Pattern: Psychologically disconnected from finances due to trauma, shame, or overwhelm.

Real Example: Marcus experienced financial trauma in childhood and now struggles to engage with money at all. Financial tasks feel dangerous and emotionally threatening.

Key Strategy: Work with a financial therapist to create extremely gentle reconnection practices with appropriate safety measures.

If you haven't already, take the Divergent Money Type QUIZ

Here are Part 1, Part 2, and Part 3 of our Divergent Money Matrix series.