Emergency Funds: The ADHD-Friendly Guide

Most emergency fund advice assumes you’re already calm, consistent, and financially stable. This version is for people who are distracted, impulsive, anxious, burned out, and maybe scared to even look at their checking account. If you’ve got ADHD—or anything like it—this is your judgment-free roadmap to finally building an emergency fund that works with your brain, not against it.

You’ll learn:

- Why ADHD makes emergency saving extra hard (but extra necessary)

- How to trick your brain into saving anyway

- ADHD-friendly account setups, apps, and habit scaffolds

- When it’s okay to use your fund—and how to rebuild it without shame

Quick Start for First-Timers: ✅ Auto-transfer $5/week to a new account named something funny

✅ Install an ADHD-friendly savings app (like Oportun or Qapital)

✅ Scroll to the checklist below and do just the first item today

Been here before? Jump to Step One: Build the First $500

🚨 Why ADHD Brains Struggle With Emergency Funds

If you’ve ever:

- Saved $200… then panic-spent it on DoorDash and a weird kitchen gadget

- Meant to set up a savings transfer… but got distracted reading 19 tabs about ADHD and savings transfers

- Thought, “This month I’ll start saving for real” for 17 months straight

You’re not broken. You’re not irresponsible. You’re neurodivergent in a world that wasn’t built for your brain.

ADHD Messes With:

- Time perception: Emergencies feel distant until they’re right here.

- Dopamine regulation: You get more reward from novelty than routine.

- Working memory: You literally forget you have a savings account.

- Emotional intensity: Money fear hits like a freight train and short-circuits planning.

That’s why you need systems, not willpower.

And here’s the twist: Emergency funds aren’t just about money. They’re about emotional safety.

💬 “Saving money is not a test of discipline—it’s a tool for nervous system safety.”

Explore more: The ADHD Money Mindset

❗️ The Consequences of Not Having an Emergency Fund

Not saving isn’t neutral. It’s risky—and ADHD can amplify the fallout.

- The Stress Tsunami: Every unexpected expense feels like a 5-alarm fire. Stress worsens ADHD symptoms, making planning and follow-through even harder.

- The Debt Domino Effect: Without a cushion, you turn to credit cards or loans, compounding the stress with new bills.

- The Opportunity Cost Conundrum: Constantly reacting to crises means missing chances to invest, change jobs, or even try a new ADHD-friendly tool.

- The Relationship Strain: It's hard to explain to your partner why you impulse-bought a llama instead of building a fund.

- The Career Crunch: No fund = no freedom to leave a toxic job or start something better suited to your neurodivergence.

Let’s shift from reactive to ready.

📦 What Is an Emergency Fund?

Think of it as your financial panic button. It's a stash of cash set aside specifically for life's "Uh-oh" moments — car repairs, surprise dental work, or escaping a bad landlord.

Starter Goal: $500 to $1,000

Ideal Goal: 1–3 months of bare-bones expenses (if income is irregular, lean toward 3)

Any cushion is better than none. Even $50 can save you from a declined card or an overdraft fee.

✅ ADHD Emergency Fund Starter Checklist

🧩 Print it. 📌 Tape it somewhere visible. ✅ Use it weekly or monthly.

- Set up a savings account named something funny ("Oh Sh*t Fund")

- Schedule an auto-transfer for payday ($5–$25)

- Install a round-up or rules-based savings app (Acorns, Qapital)

- Choose one visual tracker (jar, fridge chart, app widget)

- Celebrate every milestone (first $10, $100, $300...)

🛠 ADHD Troubleshooting: Why Saving Might Stall

| ADHD Block | What It Feels Like | Try This Instead |

|---|---|---|

| Forgetfulness | “Wait, did I even save this month?” | Set calendar + app reminders. Use automation. |

| Impulse Spending | “That Funko Pop felt urgent.” | Use a 24-hour pause rule before purchases. |

| Motivation Drop | “I’m too tired to budget today.” | Break into micro-goals + reward small wins. |

| Out of Sight = Out of Mind | “Oops, I forgot I had a savings goal.” | Post visual trackers, sticky notes, phone widgets. |

| Overwhelm | “$1,000 feels impossible.” | Just save $5. You’re practicing the habit, not chasing perfection. |

🧯 What Counts as an Emergency (And What Doesn’t)

We’ve all opened a banking app, seen the balance, and gone: "Is this the emergency? Or is this just Tuesday?"

| ✅ Use the Fund | ❌ Don’t Use the Fund |

|---|---|

| Sudden medical expense | Birthday gifts you forgot to plan for |

| Job loss or cut hours | That emotional support Instant Pot |

| Broken car or tooth | Rent (every month = budget issue) |

| Family emergency travel | Panic shopping at 1AM |

| Leaving unsafe housing | Tech “emergencies” like lost AirPods |

🧠 Ask yourself: “Will this protect my health, housing, or basic functioning?” If yes, use it. Then rebuild—no shame required.

🧠 Positive Reinforcement: Your Brain Needs the Win

Building an emergency fund with ADHD can feel like trying to fill a bathtub with a teaspoon.

But every $1 saved proves you can set boundaries with chaos.

💬 “Every dollar saved is a vote for your future calm—not your past mistakes.”

Celebrate small wins:

- Transfer made? Add a sticker to your chart.

- Hit $100? Post it in your group chat.

- Avoided impulse shopping? Screenshot your balance and high-five your future self.

You're not “bad at money.” You're just learning to build safety on your own terms.

🧱 Step One: Build the First $500

Forget the 6-month goal. That’s Chapter 17. This is Chapter One.

🔁 Automate first.

Even $5 a week is a win. It’s about pattern, not size.

🧠 Name your account something sticky.

- "Oh Sh*t Fund"

- "Panic Pillow"

- "The Llama Defense Fund"

🎯 Try one micro-habit:

- Skip takeout? Save $7.

- Finished a task? Move $10 to savings.

- Found money? → Emergency fund.

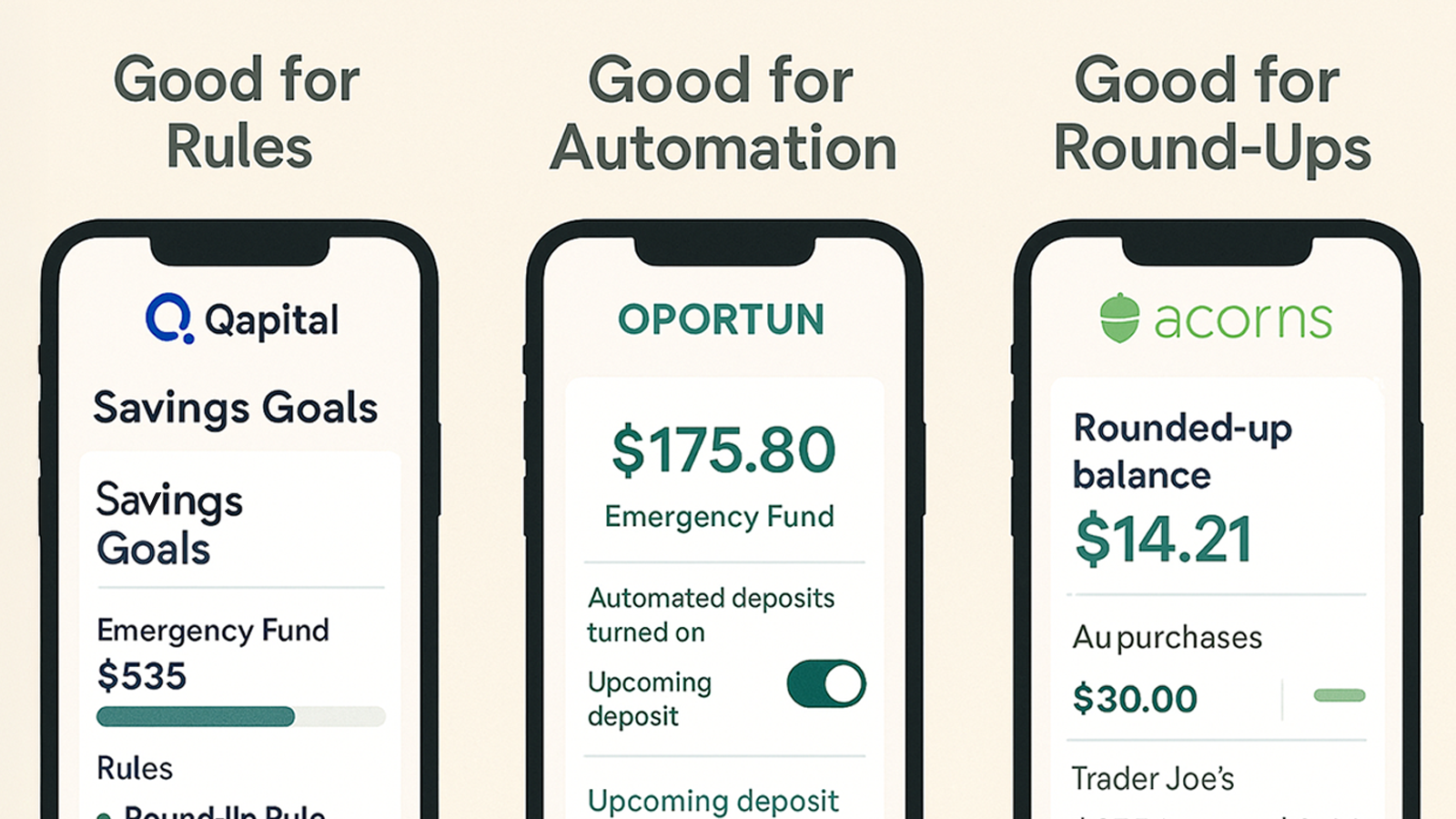

🛠 ADHD-Proof Saving Tools

💾 Apps:

- Oportun – Save automatically based on spending

- Qapital – Rule-based savings (e.g. $2 every Instagram post)

- Acorns – Rounds up purchases and invests spare change (best after you hit $500)

📊 Visual Trackers:

- Thermometer chart on the fridge

- Beads in a jar (color code by milestone!)

- Widget goal meter on your phone

⚙️ Automation Hacks:

- Transfer on payday = low friction

- Use a separate bank = less temptation

- Turn off notifications = out of sight, out of spend

🧠 ADHD-Friendly Savings Challenge

[INSERT DOWNLOADABLE BUTTON: “JOIN THE 30-DAY ADHD SAVINGS CHALLENGE”]

- Save $5 every Monday

- Use only cash on weekends

- Skip one dopamine purchase each week and transfer that money

- Track progress using a color-coded visual tracker

Complete all 4 weeks and reward yourself with something small and meaningful—paid from your non-emergency fun budget!

EXPLORE > The ADHD Money Mindset

🧠 Reframe the Goal: Save for Safety, Not Success

This isn’t a test. It’s a survival system.

Saving $100 when you live paycheck to paycheck is a bigger flex than maxing a Roth IRA on a six-figure income.

Your emergency fund is:

- A shield for your nervous system

- A vote for Future You

- A pattern interrupt for panic-to-debt spirals

💬 “You’re not building a fund. You’re building safety.”

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.