Fixing Your Credit Without Meltdowns: A Guide for ADHD and Autistic Adults

✅ Tiny win

📈 Small score bump

🧠 Confidence boost

🔁 Repeat

You’re not behind. You’re rebuilding—with tools that actually work for your brain.

Your credit score doesn’t define your worth. But it can shape your options. Let’s make those options work for you.

Let’s Start With This:

You're not "broken." We say this a LOT, because some people need to hear it, a lot. And that's ok. And it's easy to feel this way with credit scores!

Credit scores feel like report cards you didn’t ask for. Mysterious numbers that whisper judgment—often based on missed bills during burnout, trauma-induced spending, or an ADHD-fueled late fee spiral. Ugh, right? So for your benefit and mine, we're going to use cute brain characters throughout to take the edge off!

Let's start with a bit of straight talk, your credit score isn’t a character flaw. It’s a formula. A clunky, biased formula built into a system that wasn’t made for everyone. Especially not for neurodivergent brains.

Still—systems can be learned. And hacked. And slowly shifted to your advantage.

This is your no-shame, neurodivergent-friendly guide to credit scores: how they work, why they matter, and how to make them work for you, not against you.

Quick Win: Set up auto-pay for your credit card minimums today. Payment history is the #1 factor in your score—and this move locks it in.

So, What Is a Credit Score?

Your credit score is a 3-digit number (300–850) that tells lenders how likely you are to repay money you borrow. It’s generated by algorithms that crunch data from your credit behavior—like how much debt you use, if you pay on time, and how long you’ve had accounts.

Think of it like a financial GPA. It goes up and down over time, based on what the algorithm sees.

There are two main score types:

- FICO® Score – used by 90% of lenders

- VantageScore® – more common in credit monitoring apps

Both look at similar info, but weigh things a bit differently.

Credit Score Ranges — Explained Without Judgment

| Score Range | Category | Human Translation |

|---|---|---|

| 800–850 | Excellent | You’re their dream borrower. |

| 740–799 | Very Good | Solid habits. Keep it up. |

| 670–739 | Good | You're doing okay. Tweakable. |

| 580–669 | Fair | Some friction. Still fixable. |

| Below 580 | Poor | Needs care, not shame. |

Remember: Scores shift monthly. Low doesn’t mean doomed—it means you’ve got a starting point.

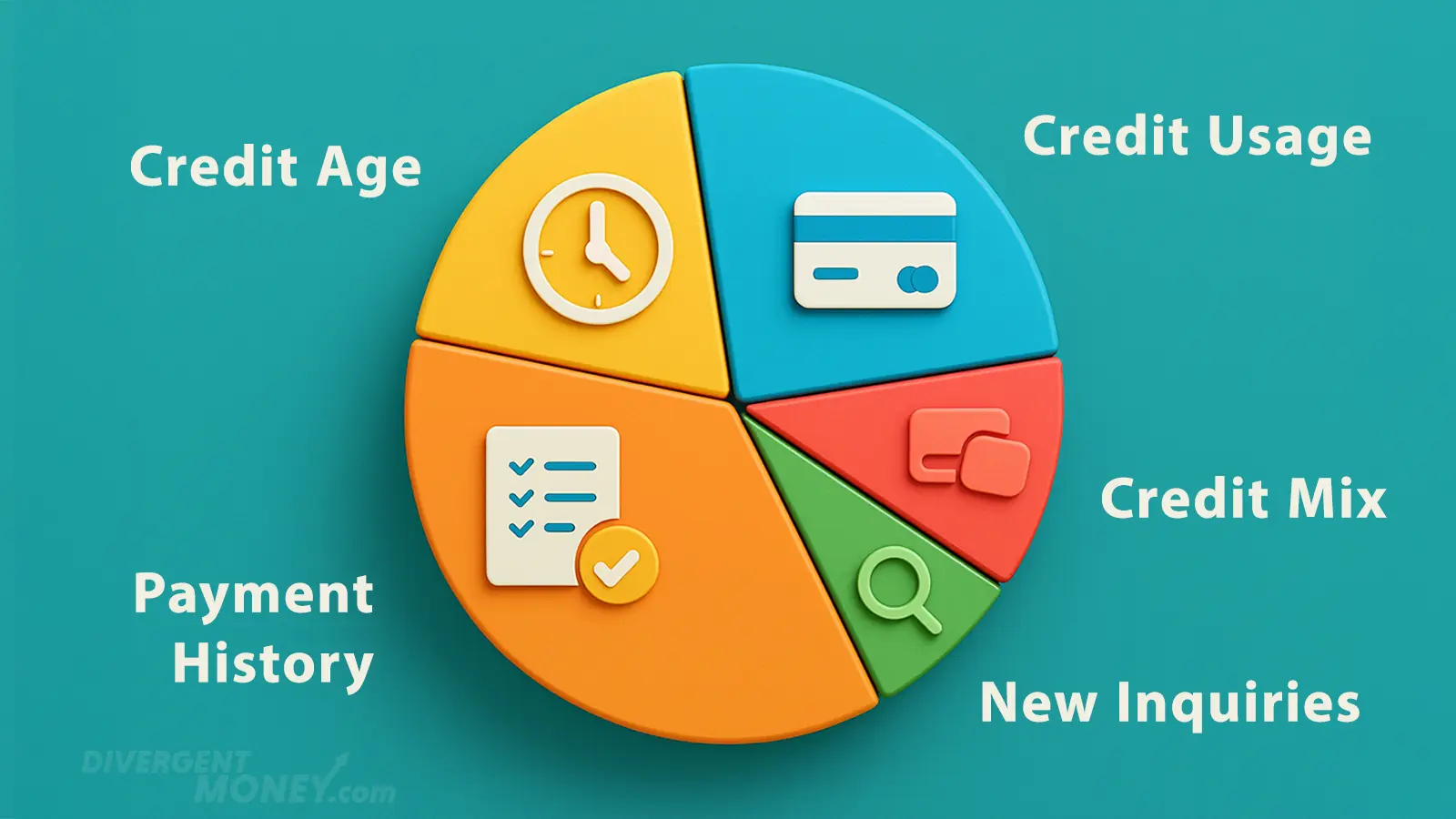

What Impacts Your Score (and What You Can Control)

| Factor | Weight (FICO) | What It Means |

|---|---|---|

| Payment History | 35% | Do you pay bills on time? |

| Credit Usage | 30% | How much of your limit are you using? |

| Credit Age | 15% | How long your accounts have existed. |

| Credit Mix | 10% | A blend of cards, loans, etc. |

| New Inquiries | 10% | Have you applied for credit recently? |

DM Tip: Consistency is hard. Automate wherever possible. If you forget to pay? Let your system remember for you.

RELATED READ: Budgeting Advice From Another Planet

Think credit scores are universal? Think again.

• In the UK (GB), your score isn’t even standardized. Experian, Equifax, and TransUnion all use different scales—so your rating depends on who you ask.

• In Canada (CA) and Australia (AU), the systems look familiar—scores range from 300–850—but their models weigh things differently. Australia, for example, puts more emphasis on positive credit behavior.

• Germany (DE) runs on SCHUFA, a centralized system that scores you from 0 to 100%. But here’s the twist: no credit history = bad score. It’s like getting penalized for being new.

• In China (CN), personal credit is evolving fast. Multiple platforms (like Baihang Credit) track everything from loans to mobile payments, but no unified score exists—yet. It's part credit, part social reputation.

Each country’s system reflects local values: trust, debt tolerance, privacy, even social mobility. That’s why a 780 in the U.S. doesn’t mean much in Berlin or Sydney.

So if you're planning a move—or just curious, it pays to check how your credit translates abroad. Your financial passport might need a new stamp.

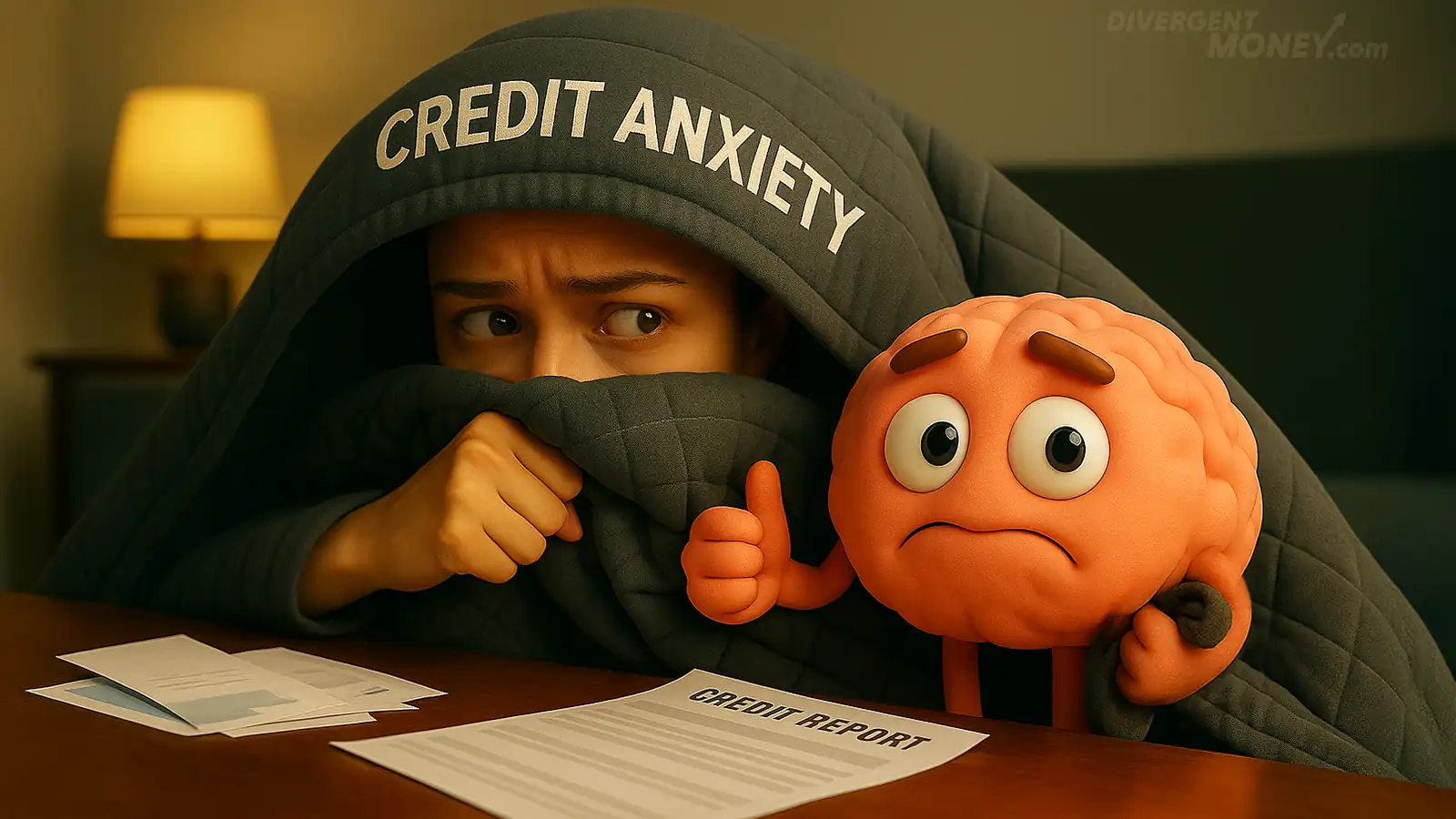

Why Credit Feels So Hard (Especially If You're ND)

Credit isn’t just numbers. For many neurodivergent folks, it’s tied to overwhelm, executive dysfunction, and past financial shame.

Common struggles:

- Shame spirals: One missed payment turns into months of avoidance.

- Masking: You pretend it’s fine while panic bubbles underneath.

- Freeze mode: Just the thought of checking your balance shuts you down.

- Task paralysis: Calling creditors? Might as well ask you to climb Everest.

This isn’t a moral failing. It’s a system clash. Let’s build tools that fit you.

Your ND Traits = Secret Weapons (Yes, Really)

| ND Trait | Credit Strength Superpower |

|---|---|

| Hyperfocus | Lock onto goals once the switch flips |

| Pattern Recognition | Spot trends others overlook |

| Love of Systems | Build rituals that reinforce healthy habits |

| Gamification Brain | Make it a score-boosting game |

| Rejection Sensitivity | Use past rejections as fuel to rebuild |

COMING SOON: Our ND Financial Toolkit – a printable + digital resource for rewiring your systems.

What If Your Score Feels Hopeless?

Meet Jamie. After a health crisis and job loss, Jamie’s score tanked to 520. They avoided everything. But eventually—one autopay. One secured card. A call to fix a credit report error. Six months later, their score hit 602.

Not perfect. But progress.

Here’s Your First Moves:

- 📄 Pull your reports from AnnualCreditReport.com

- 💳 Open a secured credit card (deposit-based, easier to get)

- 🔁 Auto-pay just the minimums — even $5 counts

- 🛠 Dispute any errors on your report

- 🤝 Ask for help — there’s no bonus for going it alone

Systemic Note: Credit scores in the U.S. reflect inequality. Median FICO in majority-Black communities: 582. Majority-white? 687. Your struggle is real—and it’s not just personal.

Power Moves: 3 Things You Can Do This Week

✅ Set up auto-pay (again, yes, it matters!)

📉 Pay down one balance below 30% of its limit

📝 Dispute one error in your credit report

FAQs: Neurodivergent Credit Questions Answered

Does ADHD or autism affect my credit score?

Not directly. But symptoms like forgetfulness, executive dysfunction, or burnout can lead to late payments or missed bills—which can lower your score over time.

Can I rebuild credit even if I’ve defaulted before?

Yes. Secured credit cards, on-time payments, and disputing errors are powerful tools to rebuild credit from any starting point.

What’s a secured credit card?

It’s a credit card backed by a refundable deposit you pay upfront. It works like a regular card and builds your credit with responsible use.

Is checking my own credit score bad?

Nope! That’s called a “soft inquiry” and it won’t affect your score.

How often should I check my credit report?

At least once per year (you can check all three bureaus for free at AnnualCreditReport.com). But if you’re actively rebuilding, once a quarter is ideal.

Want more ND-friendly financial tools?

Subscribe to Divergent Money for weekly nudges, systems, and strategies that fit how your brain works.

Want more ND-friendly finance tools?

Subscribe to the Divergent Money Newsletter for weekly tools, gentle nudges, and smarter financial systems.

In this article, learn what a credit score is, why it matters, and how neurodivergent traits can both hurt and help your score. A low-shame, empowering guide to taking your next financial step.

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.