Divergent Money Matrix Decoded: Unlock the Way You Think About Money

Part 2 of 3: Why One-Size-Fits-All Advice Fails Us?

Imagine this:

Your best friend meticulously tracks every dollar in a color-coded spreadsheet, while you avoid financial numbers entirely, hoping everything works out somehow- fingers crossed!

Or your colleague launches a creative side hustle every month, while your sibling swears by their traditional 9-to-5 and rigid budget system.

Why do we all handle money so differently?

And more importantly, why do traditional financial approaches work brilliantly for some people while leaving others feeling broken and defeated?

If you've been following us at Divergent Money, you know the answer lies not in willpower or discipline, but in neurocognitive differences—how our unique brains process financial information and decisions.

Financial education programs often fail to account for neurodiversity in learning and processing styles," notes Dr. Manju Puri, finance professor and researcher on cognitive aspects of financial decision-making. "To be truly effective, financial literacy initiatives must recognize that individuals with diverse cognitive profiles may require different educational approaches tailored to their specific strengths and challenges.

Traditional financial advice tells us to follow rigid rules—the 50/30/20 budget formula, meticulous expense tracking, and steady investment plans. Yet these systems often fail because they don't account for cognitive diversity in how we perceive, process, and respond to financial information.

The result? Millions of intelligent, capable people feel like financial failures—not because they lack discipline, but because they're trying to force their unique brain into someone else's system.

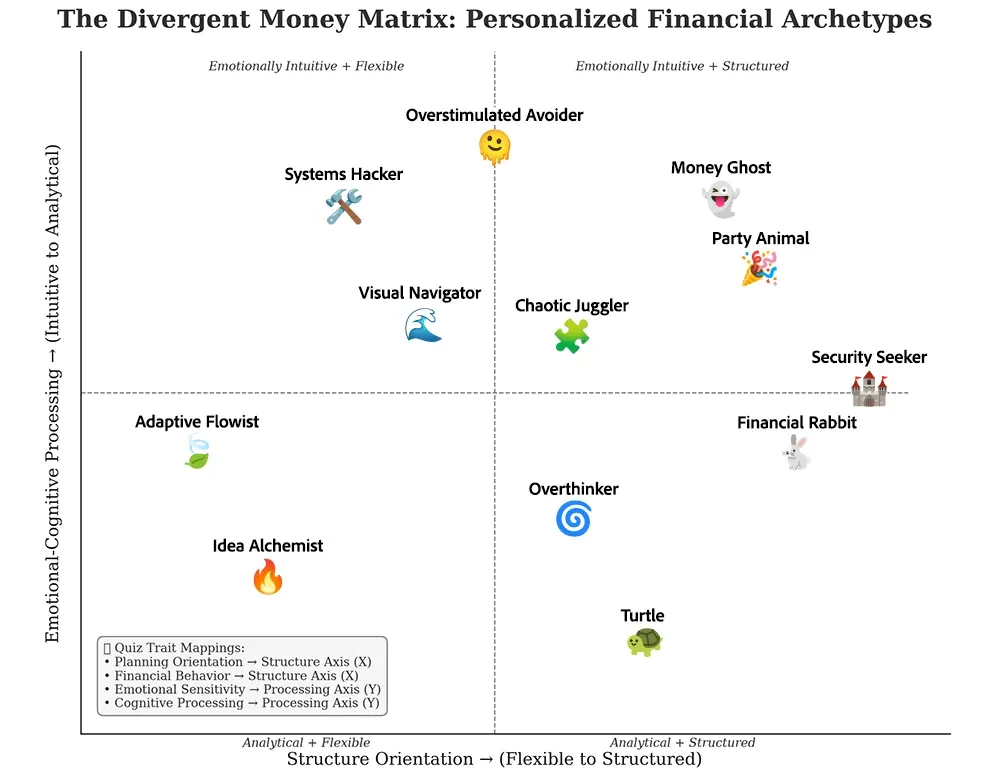

Introducing the Divergent Money Matrix

After analyzing interviews with neurodivergent individuals about their financial experiences and reviewing research in cognitive psychology, we've developed the 'Divergent Money Matrix'—a framework inspired by work from Divergent Money that maps different ways people naturally process and interact with financial decisions.

This isn't about personality types or financial archetypes—it's about cognitive patterns that shape how your brain naturally engages with financial tasks. Research on executive function differences by Dr. Russell Barkley (2012) who defined these as 'skills for regulation of behavior, emotion, and cognition in service of a goal' and cognitive processing variations in decision-making (Toplak et al., 2013) confirms that these patterns significantly impact financial management success.

Our goal with the DMM is to help you:

✔ Identify your financial cognitive strengths instead of focusing on what you "should" be doing

✔ Recognize your biggest financial challenges—and learn how to work with them instead of against them

✔ Understand why the people in your life may approach money completely differently from you (and maybe identify why those can become points of contention)

✔ Find financial strategies that align with your brain's natural patterns, reducing psychological friction

Which Divergent Money Type Are You?

Before exploring the DMM types, reflect on your financial experiences:

• Have traditional budgeting methods left you frustrated?

• Do you cycle between intense financial engagement and complete avoidance?

• Does financial advice that works for others seem impossible for you to implement consistently?

Ok, now here's a brief overview of the 12 Divergent Money Types. Each represents a distinct cognitive pattern in how people engage with their financial situation and tasks...

🛠 The Systems Hacker

Core Pattern: Creates perfect financial systems but struggles with consistent implementation.

Real Example: Michael spent 12 hours building an elaborate financial tracking spreadsheet—then never opened it again after the initial setup. He has extensive financial knowledge but minimal follow-through.

Key Strategy: Focus on simple systems with automated implementation rather than perfect design.

🔥 The Idea Alchemist

Core Pattern: Brilliant at generating income opportunities but inconsistent with financial management.

Real Example: Sophia easily launches creative side hustles but often forgets to send invoices or set aside money for taxes. She's simultaneously financially abundant and chaotic.

Key Strategy: Create automated systems that immediately route incoming money to appropriate tax, savings, and spending accounts.

🌊 The Visual Navigator

Core Pattern: Processes financial information visually rather than through numbers or text.

Real Example: Aiden couldn't stick with any budgeting system until finding one with color-coded categories and graphical interfaces. Text-heavy financial statements overwhelm him completely.

Key Strategy: Use highly visual financial tools with color-coding, charts, and minimal text.

🍃 The Adaptive Flowist

Core Pattern: Works in intense bursts of financial productivity followed by minimal engagement.

Real Example: Lin brilliantly manages money during "on" periods but leaves bills unopened during low-energy phases. Her financial system needs to accommodate these natural cycles.

Key Strategy: Build financial buffer zones and automation that maintain stability during low-energy periods.

🏰 The Security Seeker

Core Pattern: Needs clear rules and predictability to feel financially safe.

Real Example: James experiences anxiety around financial uncertainty and thrives with clearly defined systems. Unexpected expenses or decisions without guidelines create significant stress.

Key Strategy: Create detailed financial policies and scheduled reviews that provide structure and reassurance.

🫠 The Overstimulated Avoider

Core Pattern: Becomes overwhelmed by financial complexity and shuts down completely.

Real Example: Mei finds financial apps visually overwhelming. Multiple accounts, transaction histories, and notification alerts cause genuine sensory overload and mental shutdown.

Key Strategy: Choose minimal-interface financial tools and create sensory-friendly environments for money management.

🐢 The Turtle

Core Pattern: Retreats from financial reality due to shame, anxiety, or overwhelm.

Real Example: David hasn't opened bank statements in six months. What started as avoiding one overdraft notice snowballed into complete financial avoidance and mounting shame.

Key Strategy: Create a gradual, shame-free re-entry plan with tiny financial engagement steps.

🎉 The Party Animal

Core Pattern: Lives in the moment financially, prioritizing experiences over planning.

Real Example: Carlos spends spontaneously on social activities but often lacks funds for essentials because he hasn't built savings habits that accommodate his spontaneous nature.

Key Strategy: Implement "pay yourself first" automation that happens before discretionary spending opportunities arise.

🧩 The Chaotic Juggler

Core Pattern: Manages multiple complex financial streams but periodically drops critical elements.

Real Example: Amara successfully handles various income sources and accounts—until sudden catastrophic oversight, like completely forgetting tax deadlines despite having sufficient funds.

Key Strategy: Create a central financial dashboard with triple-redundant reminders for critical deadlines.

🌀 The Overthinker

Core Pattern: Gets stuck in analysis paralysis with financial decisions.

Real Example: Sam researches financial options exhaustively but struggles to actually implement choices, losing valuable time while seeking the "perfect" solution.

Key Strategy: Establish clear decision criteria, time limits, and implementation partnerships.

🐇 The Financial Rabbit

Core Pattern: Jumps between financial systems, never staying with one approach long enough to see results.

Real Example: Elena tries every new budgeting system she discovers with initial enthusiasm but gets bored before any system becomes habitual, creating a cycle of financial false starts.

Key Strategy: Build a stable automated core that remains consistent while allowing for periodic "refresh" of interfaces and approaches.

👻 The Money Ghost

Core Pattern: Psychologically disconnected from finances due to trauma, shame, or overwhelm.

Real Example: Marcus experienced financial trauma in childhood and now struggles to engage with money at all. Financial tasks feel dangerous and emotionally threatening.

Key Strategy: Work with a financial therapist to create extremely gentle reconnection practices with appropriate safety measures.

For a comprehensive understanding of your type, including detailed real-world examples and specific implementation strategies, explore our individual guides and quiz coming next week!

* Coming Next Week... The DMM Part 3 of 3 + The Money Matrix Quiz! *

This article provides educational information only and is not financial advice. Individual circumstances vary widely, and financial planning involves complex considerations. Consider consulting with a financial professional who understands diverse cognitive styles before making significant financial decisions.