Budgeting Advice From Another Planet

Why 'Just Stick to a Plan' Doesn’t Work for ADHD and Autism

Budgeting advice is everywhere. "Just track your expenses!" "Automate your savings!" "Stick to a plan!"

But for neurodivergent people—especially those with ADHD or autism—this advice often feels like it was written in an alien language. Your brain may process time, memory, motivation, and decision-making in fundamentally different ways than the person giving you advice.

TL;DR: Budgeting Tips for Neurodivergent Adults

• ADHD and autistic people benefit from systems tailored to their unique cognitive patterns

• Adaptation > discipline: You’re not bad with money—you just need different tools

In this guide, we'll explore why neurotypical budgeting systems often fail ADHD and autistic brains, how to communicate your financial needs to others, and how to build an adaptive financial system that actually works for you—without shame, friction, or spreadsheets that haunt your dreams.

🚨 Understanding Why Traditional Budgeting Advice Fails

Why Neurodivergent People Struggle With Money

If you're neurodivergent, budgeting systems that work for others might break down at the point of initiation, follow-through, or memory. The cycle looks like this:

- You try a traditional budgeting app or method.

- It doesn’t work the way it’s “supposed to.”

- You blame yourself instead of the system.

- Shame kicks in. Avoidance takes over. Things get worse.

It’s not a personal failure. It’s executive dysfunction meeting unrealistic systems.

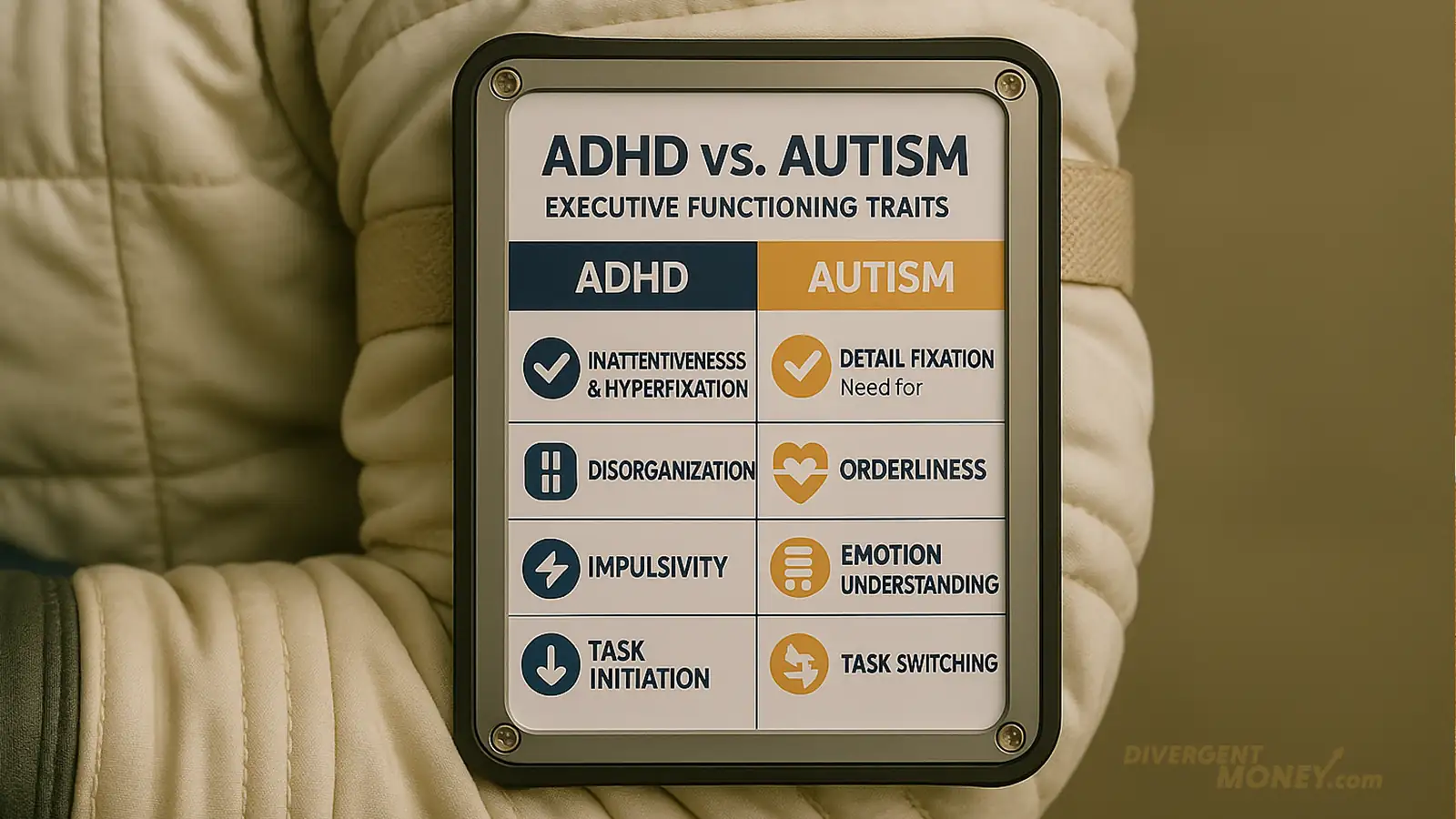

Executive Function Comparison: ADHD vs. Autism

Let’s break down why traditional budgeting advice can feel so out of reach and how neurodivergent brains approach financial decision-making differently.

Executive Function & Money: How ADHD and Autism Compare

| Executive Function Challenge | ADHD | Autism |

|---|---|---|

| Task initiation (starting things) | ✅ Very common struggle | ✅ Can occur, but often due to anxiety or preference for routine |

| Organization & time management | ✅ Very common struggle | ✅ Possible, especially with inflexible thinking |

| Impulse control | ✅ Huge struggle | ❌ Less common—autistic people tend to overthink rather than act impulsively |

| Task switching / shifting focus | ✅ Hard to shift attention away | ✅ Can struggle, but often due to deep focus on one thing rather than distractibility |

| Planning & prioritization | ✅ Chaotic, often “winging it” | ✅ Can struggle, but prefers structured plans (even if rigid) |

| Working memory | ✅ Very common struggle | ❌ Not typically a defining challenge |

| Rigid or inflexible thinking | ❌ Not common—ADHD is adaptable but inconsistent | ✅ Very common—autism thrives on routine and predictability |

Understanding these differences is critical to having better conversations about money—both with yourself and with others.

The Executive Dysfunction Tax 🧾

Me: “This bill’s due in 14 days. I’ll pay it tomorrow.”

Tomorrow Me: “Oops. The day after.”

Next Day Me: “Okay, now I’m doing it! Wait—why did the app crash?”

Final Me: “Welp. Missed it. Late fee applied.”

Actual story: One time I got a $45 late fee for forgetting to pay a $12 charge. I'd remembered it three separate times—and never once acted on it. My brain said "tomorrow." Tomorrow never came. Strictly speaking, the above is a lie, it wasn't just one time, dozens, maybe hundreds of missed payments- simple things, overdrafts, forgotten subscriptions, the intangible taxes of shame and extra effort applied to tasks. If I may speak freely, "Ugh!"

💬 Explain Your Financial Needs to Neurotypical People

You’ve probably heard some of these phrases:

- “Just try harder.”

- “Why can’t you just follow the plan?”

- “You’re so smart though.”

- “Just use an app. It’s easy!”

Here’s What You Can Say Instead:

- “I process financial decisions differently.”

- “I need systems that work with my brain, not against it.”

- “I struggle with [X], but I thrive with [Y].”

- “Can we collaborate on something that works for both of us?”

ND-Friendly Budget Hacks:

- “I forget to log purchases, but automatic text alerts help me track them.”

- “Autopay prevents late fees—manual payments are risky for me.”

- “Spreadsheets don't work for me, but visual budget tools do.”

🎨 Make Budgeting Sensory-Friendly

Financial Advisor: “You need a simple, sustainable budget.”

Autistic Me: “Got it.”

✨ Spends 5 hours creating the most satisfying, pastel-toned, click-sound-enhanced budget tracker ever made.

😶 Still forgets to open it.

🔧 Build a Budget System That Works for ADHD & Autism

Forget one-size-fits-all. Try these ND-friendly budgeting strategies:

- ✅ Automation – Set up autopay, savings rules, and alerts.

- ✅ Visual Tools – Use color-coded apps, envelope systems, or icon-based planners.

- ✅ Gamification – Track goals with points, streaks, or rewards.

- ✅ Money Sprints – Use hyperfocus to your advantage once a month.

- ✅ Accountability Systems – Partner with a friend or financial coach (even AI).

🪐 Stranger In A Strange Land: Rethinking Personal Finance for Neurodivergent Minds

If traditional money advice doesn’t work for you, it wasn’t meant for your brain. And that’s okay.

Our brains are wired differently. That means our tools, reminders, motivators, and systems need to be different too.

Personal finance wasn’t built for neurodivergent thinkers—but that doesn’t mean you can’t build a system that fits. You just need to design around how you actually operate.

Progress over perfection. Always.

Ready to Budget Like Your Brain Works?

If this resonated with you:

- 👉 Forward this to someone who gives you budgeting advice—and doesn’t quite get it.

- 📬 Subscribe to the Divergent Money Newsletter for weekly ND money tools

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.