"ADHD Money" Book Review: The Best Finance Guide for Neurodivergent Brains?

ADHD Money is the first personal finance book we’ve read that doesn’t feel like homework. It’s short, funny, deeply kind, and — best of all — built with your brain in mind. Whether you’re overwhelmed, burned out, or just tired of feeling “bad with money,” this book offers structure without shame and tools that actually fit the way you function.

⭐️⭐️⭐️⭐️⭐️

Let’s Be Honest: Most Finance Books Are a Bust

You know that thing where you buy a finance book with good intentions, skim a chapter or two, then abandon it halfway through because your brain just can’t? Yeah, us too.

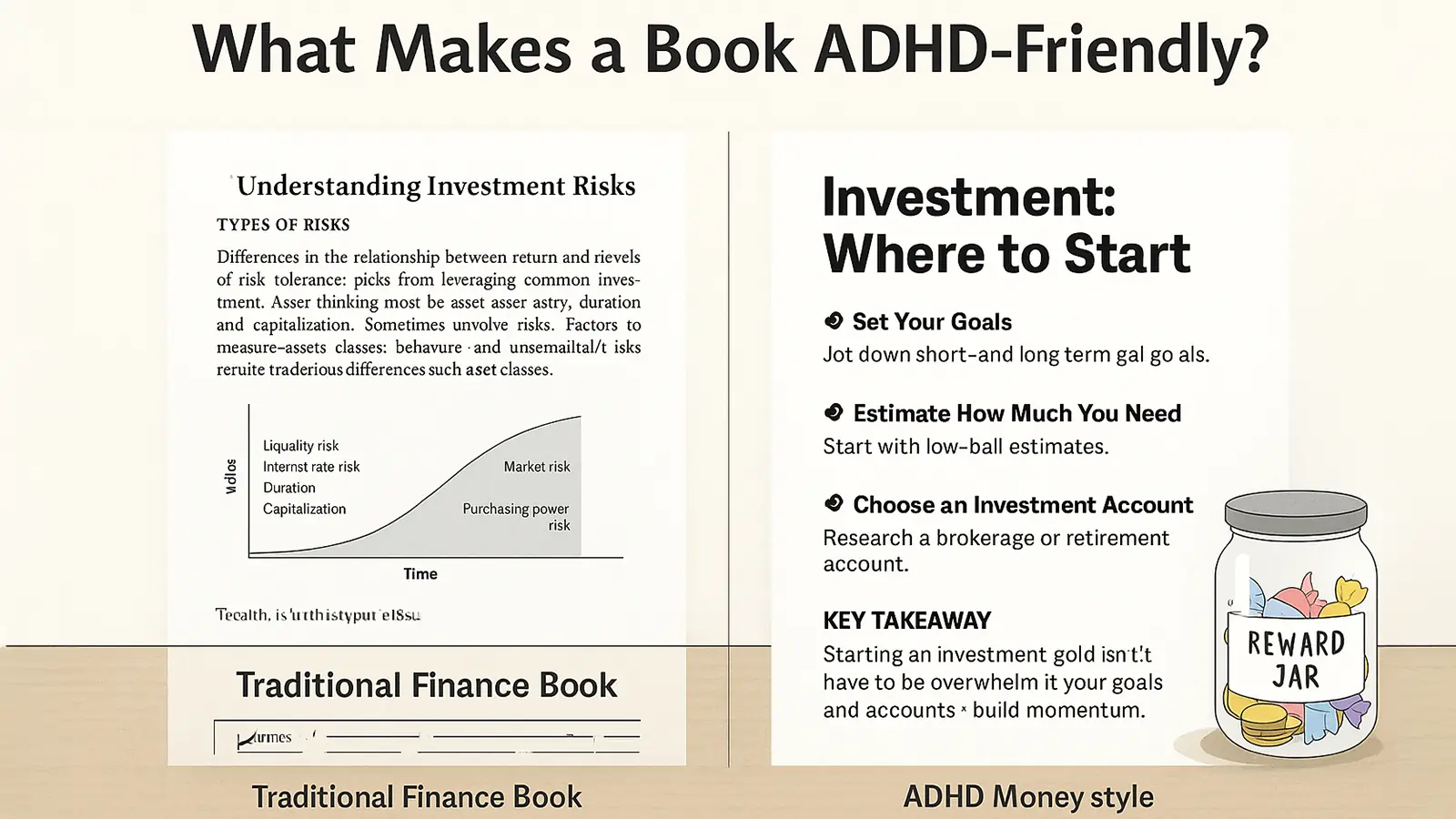

ADHD Money is different. It doesn’t ask you to push through, try harder, or magically transform into someone who enjoys spreadsheets. It rewrites the whole format — breaking money down into small, skimmable, dopamine-sparking pieces. The author doesn’t just understand ADHD. She’s designing with it.

Instead of pretending we’re all just “easily distracted,” this book builds a toolkit for people whose brains are wired for novelty, pattern recognition, and urgency — not monthly budget reviews.

What Makes This Work So Well?

🔁 It’s Designed Around How ADHD Actually Functions

- Short chapters: You can read one in five minutes and feel like you accomplished something.

- Bold, skimmable formatting: Miss a paragraph? Doesn’t matter. You’ll still catch the key points.

- Nonlinear structure: Flip to the chapter you need — skip the rest.

- Intentional repetition: Not filler. Just enough to make ideas stick.

- End-of-chapter actions: So you know exactly what to do next, without overthinking it.

Instead of overwhelming you with theory, Mathams builds forward momentum. That alone sets this book apart.

The Best Tactics Inside

🪣 A Flexible Budget That Won’t Break Under Pressure

Forget color-coded spreadsheets. ADHD Money walks you through a “bucket” method that feels more like setting up guardrails than keeping receipts. It helps you move money with purpose—without needing to track every coffee.

⏸️ Real Tools for Impulse Spending

You’re not told to “just stop buying stuff.” You get options—like the 48-hour wishlist pause for online purchases. No shame, just gentle friction that slows things down without making you feel punished.

🙅♀️ Debt Without the Guilt

This isn’t a “cut up your credit cards and cry” kind of book. The debt chapter walks you through how to prioritize and automate your payments in a way that feels doable. If you’ve ever avoided your balances out of dread, this part alone is worth the price.

🤝 Accountability That Actually Works

Instead of relying on willpower (which ADHD brains burn through fast), the book offers external systems:

- Telling a friend your savings goal

- Using apps that track streaks

- Finding community support when motivation crashes

🎮 Gamifying Your Finances

You’ll learn how to set up little wins and visual streaks that feel more like a mobile game than a budget. It’s not cheesy—it’s effective. Especially when your motivation comes in waves.

What Makes This Book Stand Out

This isn’t just a money book with “ADHD” slapped on the cover. It’s clearly written by someone who’s been there. You feel it in every line.

- No “you just need more discipline” advice

- No assuming you can maintain the same energy every week

- No pretending the problem is you

Mathams treats ADHD not as a flaw to overcome, but as a system to design around. She makes it feel normal to build workarounds instead of trying to force what doesn’t work.

“I always thought I just sucked at money. This book showed me I was using the wrong tools.” — DM Reader (shared with permission)

Zooming Out: It’s Not Just You

This part matters: the financial system itself is often hostile to executive dysfunction. From late fees to confusing interest structures to the way banks profit off forgetfulness — it’s not just your brain that’s the issue. It’s the infrastructure.

ADHD Money doesn’t go full-on policy critique, but it does acknowledge the unfairness baked into traditional money systems. That alone makes it more honest than most books on the shelf.

“You’re not bad with money. You’re just not wired for systems that expect perfect memory, consistency, and zero dopamine debt.”

What It Doesn’t Do (And It’s Okay)

- It’s not a deep dive on investing or tax optimization

But it’s not supposed to be. This is your first domino, not your dissertation. - Some tools are basic

You might’ve heard of apps like YNAB or the 50/30/20 rule. But if you’ve struggled to use them consistently, the way they’re framed here might finally make them work for you. - Yes, it repeats a few points

But if you’ve ever read the same paragraph three times and still blanked, you’ll be grateful for it.

Who This Book Is For

- 🧠 ADHD adults or anyone struggling with executive function

- 👩👧 Parents of teens who want to teach real-world money habits without lectures

- 🧩 Autistic or otherwise neurodivergent readers who want systems that flex

- 😵💫 Anyone who’s burned out on traditional finance books and wants something they’ll actually finish

Divergent Money's Take: 4.95/5

(ok, let's just say 5!!)

ADHD Money is what happens when someone finally stops telling you to “just be better with money” and instead shows you how to make money work better with your brain. It’s structured for clarity, paced for dopamine, and anchored in real-life struggles most books ignore.

It doesn’t expect perfection. It rewards progress. And that’s exactly what makes it a book worth finishing.

Want our ADHD-Friendly Budget Template inspired by ADHD Money? Grab it here for free.

⭐️⭐️⭐️⭐️⭐️ — Full 5 stars for the Divergent Money blog!