ABLE Accounts: What Most Caregivers Get Wrong (And How to Fix It)

Written for caregivers of neurodivergent and disabled loved ones who’ve been burned by misinformation, overwhelmed by benefits rules, or just never told what tools were actually available.

The first time someone mentioned an ABLE account to me, I assumed it was some kind of scam.

I’d spent years obsessing over SSI limits, Medicaid eligibility, and asset thresholds. I’d memorized what we could and couldn’t do. My daughter was 22. No caseworker, doctor, or benefits counselor had ever mentioned ABLE. I found out from a friend in a Facebook group.

She messaged me:

“You know you can save money for her without losing benefits, right?”

I didn’t believe her.

Turns out, she was right. I was wrong. And we’d already left years of savings potential on the table.

What Is an ABLE Account—Really?

An ABLE account (short for Achieving a Better Life Experience) is a special savings and investment account for people with disabilities. It lets them (or their families) set aside money—up to $100,000—without it counting against government benefit limits like SSI. That money can grow tax-free and be spent on a huge range of things that help them live, work, or stay independent.

Think: housing, transportation, education, therapy, assistive tech, even job coaching or rent.

It’s like a financial force field around your loved one’s savings—if you know it exists.

Who’s Eligible (and Why So Many People Get This Wrong)

The rules are deceptively simple:

To open an ABLE account, your loved one must have developed a qualifying disability before the age of 26.

But what counts as a “qualifying disability”? That’s where most people get tripped up.

If your loved one is already on SSI or SSDI and their disability started before 26? They're eligible.

If not, they might still qualify if they meet the Social Security Administration’s definition of “significant functional limitation.”

![TIMELINE SHOWING HOW ABLE ELIGIBILITY CAN APPLY TO OLDER ADULTS DIAGNOSED EARLY]](https://www.divergentmoney.com/content/images/2025/03/DM_ABLE_eligibility.png)

That includes a lot of neurodivergent folks:

- Autistic individuals (diagnosed or self-ID, with functional challenges)

- ADHD, if it substantially limits daily functioning

- Intellectual or developmental disabilities

- Mental health disorders (like schizophrenia or severe depression)

- Neurological conditions (like cerebral palsy or epilepsy)

And starting in 2026, the age cutoff expands to 46—potentially adding 6 million more people, especially adults diagnosed later in life.

The 5 Myths That Keep Families From Using ABLE Accounts

💣 MYTH #1: “It’ll Mess Up Our Benefits”

I used to believe this too. We were terrified of going over the $2,000 asset limit. I’d pull money out of my daughter’s account just to keep it under.

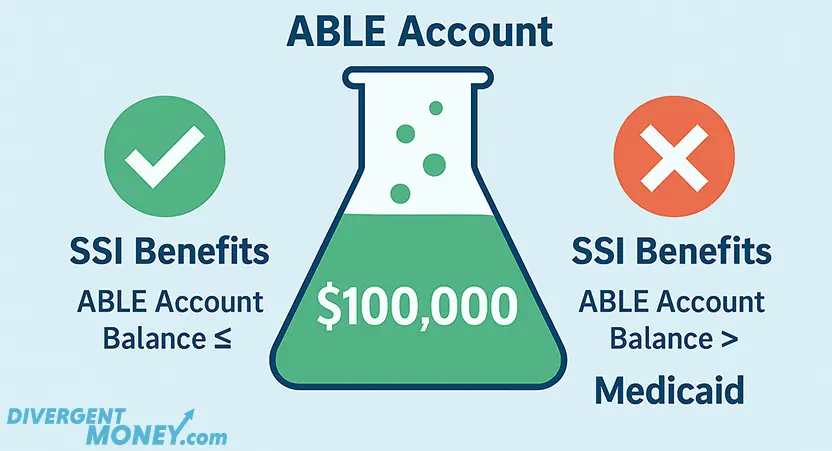

TRUTH: You can have up to $100,000 in an ABLE account and still get SSI. Go over that, and SSI gets paused—but Medicaid stays intact.

💬 Real Talk: “I used to think every dollar in her name was dangerous. Now we put $50/month in her ABLE and I sleep better.”

🧸 MYTH #2: “These Are Just for Kids”

ABLE accounts aren’t just for minors. They’re for anyone whose disability began before 26. Whether your loved one is 5 or 55, it doesn’t matter.

TRUTH: If they meet the age-of-onset rule, they can open one today—and starting in 2026, that age bumps to 46.

🎯 Example: An autistic adult diagnosed at age 4 but now 40? ✅ Eligible.

💸 MYTH #3: “I Can’t Afford to Contribute, So Why Bother?”

Most of us aren’t sitting on extra cash. But the magic of ABLE is that even small contributions add up, especially with tax-free growth.

TRUTH: $20/month = $240/year = $1,200 in 5 years (without even counting investment gains). Plus, family and friends can contribute too—holidays, birthdays, graduation.

💬 Real Talk: “We started with $25 a month. It felt like nothing—until it wasn’t.”

🏦 MYTH #4: “It’s Just a Fancy Savings Account”

This one really hurts people. Because it’s not just a savings account—it’s also an investment account.

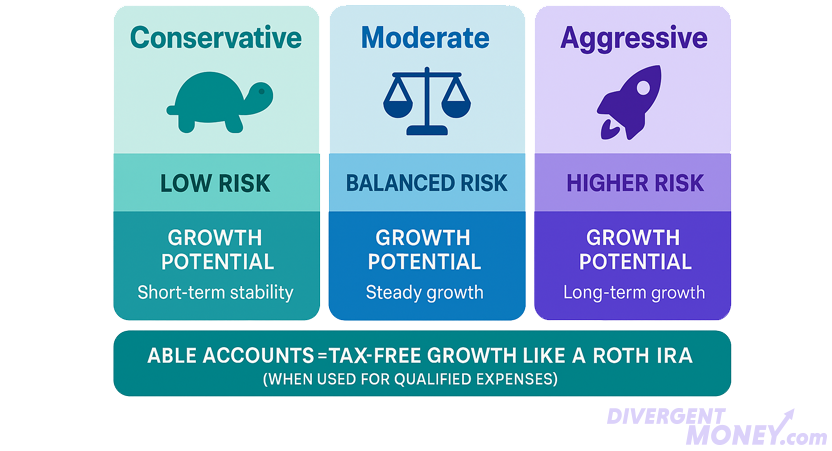

TRUTH: Most ABLE programs offer investment options, from conservative to aggressive. It’s like a Roth IRA, but for disability-related expenses.

Check your state’s plan—some offer low-fee index funds or target-date portfolios.

🔎 Action Step: Compare ABLE programs at ablenrc.org

🏥 MYTH #5: “It’s Only for Medical Stuff”

We thought we’d have to fight for every withdrawal. Not true.

TRUTH: ABLE money can be used for Qualified Disability Expenses (QDEs)—a broad list that includes:

- Rent

- Car payments

- College tuition

- Job training

- Laptops or iPads

- Support services

- Legal fees

- Even a service dog

🎯 Example: We used ABLE funds for her Lyft rides to therapy. Totally covered.

So… What Should You Do Now?

If you’ve made it this far, odds are your loved one probably qualifies. And even if you’re still unsure, that’s OK—the most important thing is to ask.

✅ Here’s your next move:

- Check eligibility. If they’re on SSI/SSDI or have a significant functional limitation with onset before 26 (or soon, 46), they may qualify.

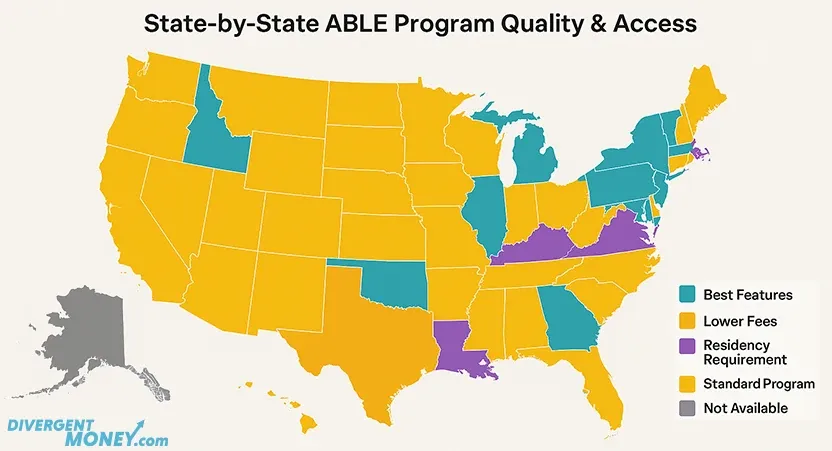

- Compare ABLE programs by state. Look for low fees, good investment options, and user-friendly tools.

- Start small. Even $10 or $20/month is a win.

- Loop in family. Aunts, uncles, grandparents—ABLE is a great alternative to gifts that disappear.

You’ve been told to “just keep everything under $2,000.” But that’s not a plan—it’s a trap. ABLE is the way out.

Let’s stop leaving money, peace of mind, and future options on the table.

Disclaimer: As ALWAYS, this article is for educational and motivational purposes and is not financial advice. Always consider consulting with a financial professional for guidance tailored to your unique situation.